SALEM, Ore. — This week, Oregon lawmakers got a look under the hood of the state's economy, hearing how tax revenues are doing thus far this year. While it's a dense subject, those outcomes will have a big impact on taxpayers — particularly if Oregon's unique kicker law comes into play.

Oregon's state agencies run at the mercy of a variety of taxes, including personal income taxes and corporate taxes — the two biggest in terms of economic health. As a result, the legislature receives regular reports from economists at the Oregon Department of Revenue, who keep track of those numbers and analyze trends.

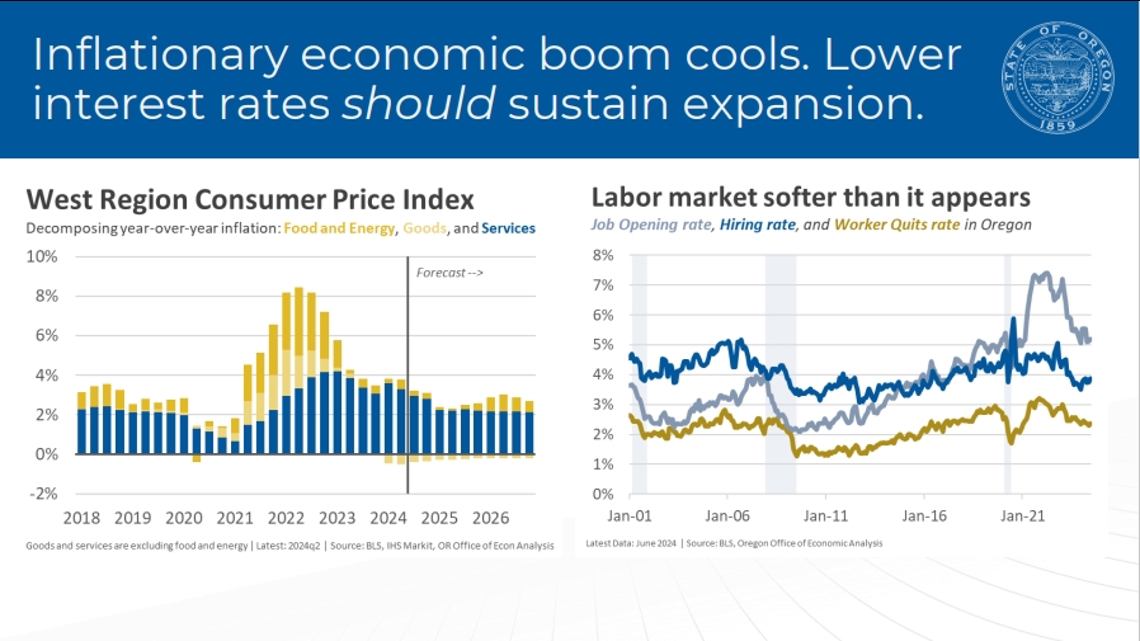

Josh Lerner is Oregon's acting state economist, and he led lawmakers Wednesday through the latest report. On his first slide, he described how inflation is cooling down after being wildly high in 2022 and into 2023. On the other hand there's the job market, which is very tight in Oregon right now.

"While a lot of the top line indicators for the economy are still doing quite well, right, unemployment is still relatively low. The employment rate is still high, job growth is still positive — like, there's a lot of good things about the labor market today," Lerner told lawmakers. "But the hiring rate has slowed down tremendously. It's kind of the dark blue line here.

"And the chart on the right, where the actual pace of hiring — this is Oregon data, national similarly is the lowest it has been in about a decade, right? Job growth is pretty slow. So if you have a job, it's good today. But if you're looking for a job, it's harder to find one than it has been really in the last handful of years."

"The labor market, labor having trouble finding new jobs if they're laid off or fired or leave, is that ... can you characterize that as across the board, or is that in higher income jobs or is that in lower income jobs?" asked southern Oregon Rep. E. Werner Reschke.

"I would say some of the weakness, especially in those more rate-sensitive sectors are what we would call middle wage jobs, you know, construction and manufacturing in particular has added few jobs or lost jobs. In manufacturing's case, in recent years ... (it's) much, much harder to find to find a job today, if you're searching for that type of employment, also in terms of layoffs."

That said, Lerner added, layoffs have started to make a dent in some of Oregon's typically higher-earning fields, particularly tech-adjacent ones — big companies like Intel and Nike, both of which have made major cuts.

"Now we're talking about semiconductor-related layoffs in Oregon, in apparel and footwear layoffs in Oregon, and that sort of thing," Lerner continued. "So that's certainly much more tilted towards, you know, college-educated, higher-paying positions and the like. And so there's even been the term 'white collar recession' thrown around in some of the media reports ... in the last couple of years. And so we've certainly seen that in the data."

For some companies, a slump

Generally speaking, Oregon's economic engine is running well. But it's clear that for people looking for work, it's more difficult in some sectors than others — and Lerner's outlook is somewhat mixed for some of Oregon's biggest industries.

"I think the long-term outlook for semiconductors in Oregon is still bright," Lerner said. "We have the upcoming investments — at least, if we heard something else, you know, we would change that assumption. I think that is good news. The challenge today is that semiconductors in Oregon, while there's hundreds of firms technically in the cluster, it is dominated by one large firm, right? And that's the one firm where we're seeing the announcement.

"So maybe opportunities within other employers within the cluster maybe are a little more ... you're less diverse just given that, whereas footwear and apparel, right, you know we have a number of large multinational companies with headquarters or headquarter-type operations in Oregon. And so while one of them may be seeing some layoffs, the other ones are growing, and so you're able to keep those workers with the skills you know, tailored to the specific industry cluster locally."

Lerner again referenced Intel, which announced recently it would cut some 15,000 jobs globally in order to save $10 billion next year, in spite of the influx of funding it's seen from the federal CHIPS and Science Act. The precise impact in Oregon is yet to be seen, but it will certainly be felt when it happens.

Oregon has other companies benefitting from the semiconductor boom, but there's no game in town anywhere near as big as Intel.

Then there's Oregon's timber industry. While it was once an economic powerhouse for the state, things have changed dramatically over the last half-century or so.

"You know, we've been seeing the long-term structural decline in wood products in Oregon for two generations or longer at this point, right?" Lerner said. "And so I think when you see some of these closures, if we see full closures, it takes a lot of capital and investment to start back up again. And so I think you tend to see a ratchet down and then stability and then a ratchet down, then stability. And so I wouldn't be super optimistic about long-run growth for the industry, just given trends for the last 40 years."

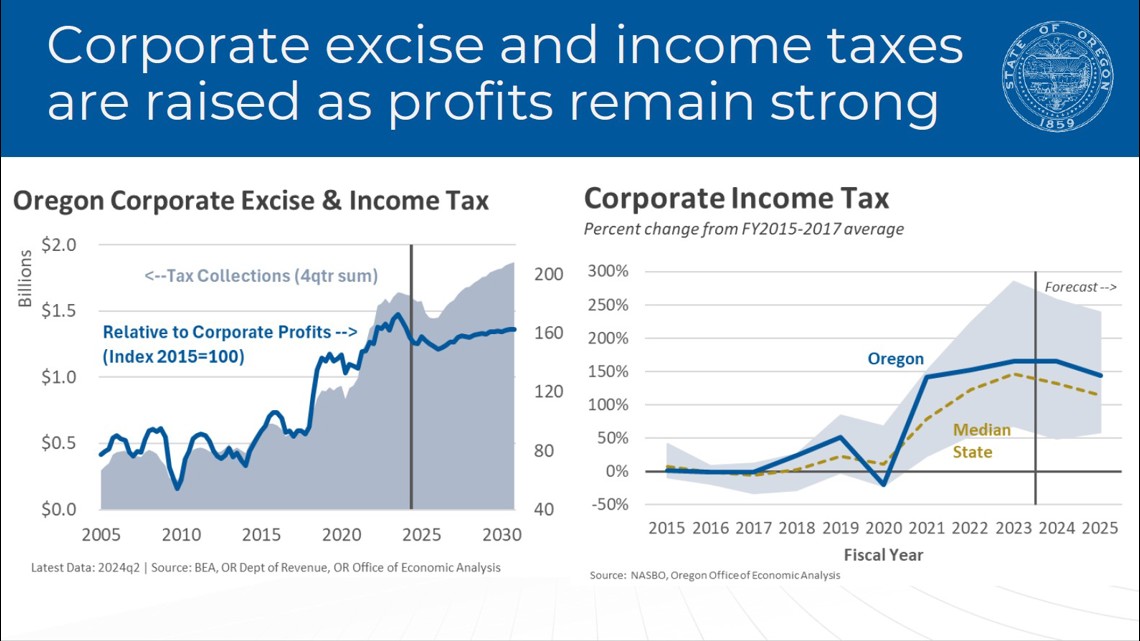

One slide of Lerner's compared corporate tax rates and profits. Corporate tax collections appear to be just on the other side of a peak, and they're down somewhat relative to corporate profits. Regardless, those tax collections are strong compared to years before 2020, in particular.

Nationwide, Oregon's corporate income tax is near the middle of the pack in terms of how it's gone up, after bottoming out in 2020 and surging ahead in 2021.

Taxes, the kicker and you

Corporations aside, personal income taxes are a big driver of Oregon's economic engine. And with many Oregonians working right now, more tax money is coming into state coffers than predicted. Assuming things keep going this direction, that means a bigger kicker refund for taxpayers in 2026.

"Bottom line, for the General Fund revenues — this is for the current budget period, for '23-25 General Fund only — are up considerably, right?" Lerner said. "Available resources are up $676 million since we last produced a forecast a couple of months ago. Two-thirds of that change is tracking actual collections through the door in the last three months, you know, are nearly $500 million above the forecast.

"And trying to think through what the implications there are or why that is such a large change, you know ... is it that collections have boomed, you know, much stronger than anticipated, or is it that our forecasts were maybe overly pessimistic, or is it the forecast was too low, or is it the revenues are much higher than fundamentally you would expect? And I think it's more the latter than the former, I think.

"You know, the flavor of the outlooks were right. We're expecting a decline in corporate and we got stability in corporate. We're expecting a 50% decline in personal income taxes on a year-over-year basis, cause we're paying out the kicker, right? ... But with the kicker, we expected a 50% decline last quarter year-over-year, and we got a 45% decline year-over-year. So I think it's maybe that the forecasts were a little too pessimistic — and it's not so much that the revenues are going gangbusters relative to the broader economy, I think. That's part of it."

READ MORE: How does Oregon's 'kicker' tax rebate work?

The other part is that Oregon is getting $300 million more in corporate taxes than expected.

The net result is that Oregon's unique tax refund, the kicker, could kick in. Under state law, at the end of each two-year budget cycle, state economists make their best guess on how much tax money will come in for the next two years. If it turns out to be 2% or more than they guessed, every taxpayer gets a refund, known as the kicker.

Currently, state economists expect tax collections will be nearly $1 billion higher than expected — $987 million, to be exact. That would mean a tax refund of between $200 and $400 for every taxpayer, depending on income bracket. Those numbers will likely change between now and 2026 as more revenue data comes in.