MULTNOMAH COUNTY, Ore. — Multnomah County is now expected to see a budget deficit of $21.2 million for the 2026 fiscal year, with the county's economist Jeff Renfro announcing the staggering number during Tuesday’s county board meeting.

Earlier this year, it was expected the county would see a $16 million deficit, but now, the forecast has shifted.

The primary factor responsible for such high expenses relate to paying personnel for county services and programs.

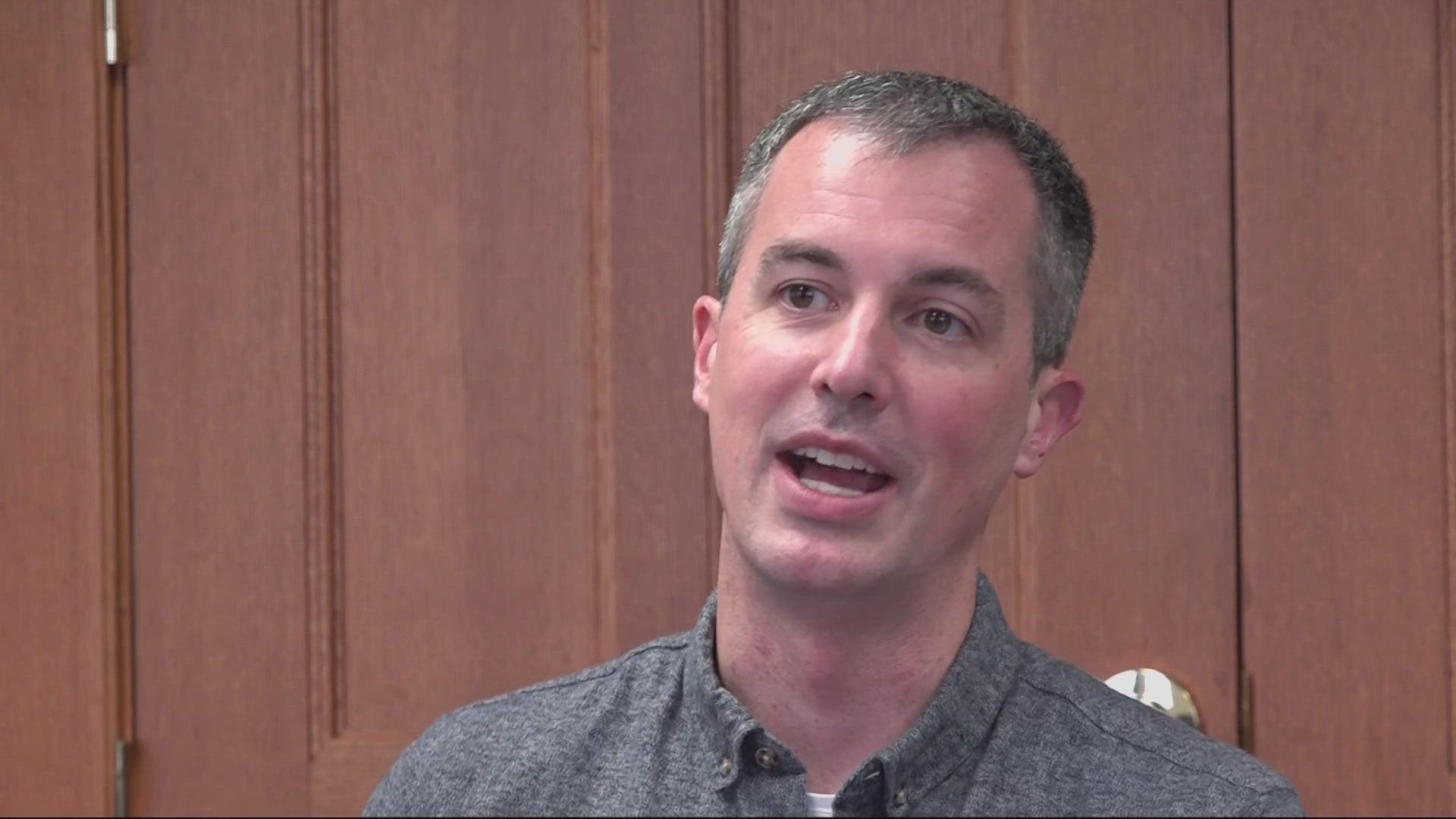

“In the simplest terms, the county is paying people to do the work to implement our programs. So, in our general fund, personnel costs are over 60% of our expenditures,” said Renfro.

Some of these programs include public safety, with the money being needed to operate jails, the District Attorney’s office, other law enforcement components, as well as other health and human services.

RELATED: Portland's new city government will need to fill a major budget hole, likely through layoffs

“A lot of our personnel cost increases are dictated by inflationary factors that are outside of our control. We really don't have a lot of levers that we can pull other than evaluating the level of programming we deliver to the community,” he continued.

For the county to continue to fund their current service level, Renfro said they would need around $30 million in new revenue to remain steady.

He added that property taxes make up 63.5% of discretionary general fund revenue. However, for 2026, it’s expected the taxes will only yield around $8 million in new revenue.

“The main reason our property tax revenue is so low is declines in downtown ... property values are slowing the growth of property tax revenue over time,” said Renfro.

This is connected to downtown’s high building vacancy rates, which become more of a significant problem post-pandemic.

“Property owners are unable to get people to rent space in their buildings over time, they have difficulty making debt payments, if they have debt on their building, those buildings end up getting sold and sold for values that are lower than they were pre pandemic," he said.

As a result, that leads to lower property tax revenue.

Assuming expenses continue to grow, the deficit amount is projected to grow to a little over $50 million by 2030.

However, Renfro also said that the budget process that will occur in 2026 will require a balanced budget, so that will shift the expense trajectory down.

“We're going to have to cut real services that are delivered, so the board — it's going to be up to them to go through a prioritization process to figure out exactly how that works,” said Renfro.

During Tuesday’s meeting, Commissioner Julia Brim-Edwards said local government must continue tackling homelessness issues and other major problems in the city to stop more businesses from leaving.

“If the city and the county don’t continue to take strong steps to address homelessness, behavioral health issues and compromise public safety in our neighborhoods, the business that has resources to move will leave the county, and that in the end leaves us with fewer resources to deliver core services,” she said.

“There’s a direct correlation between the economic health and the conditions in the county and the resources that we have," she continued.

The budget will be officially adopted in June 2025.

Before that, community members will be allowed to speak in front of the board and submit ideas regarding the budget, which the commissioners will take as feedback.