PORTLAND, Oregon — Water is essential. It keeps us alive. Yet it’s this necessity, water, that’s thrown a Portland family into a financial tailspin. Their bank accounts were frozen because of an unpaid Portland water bill.

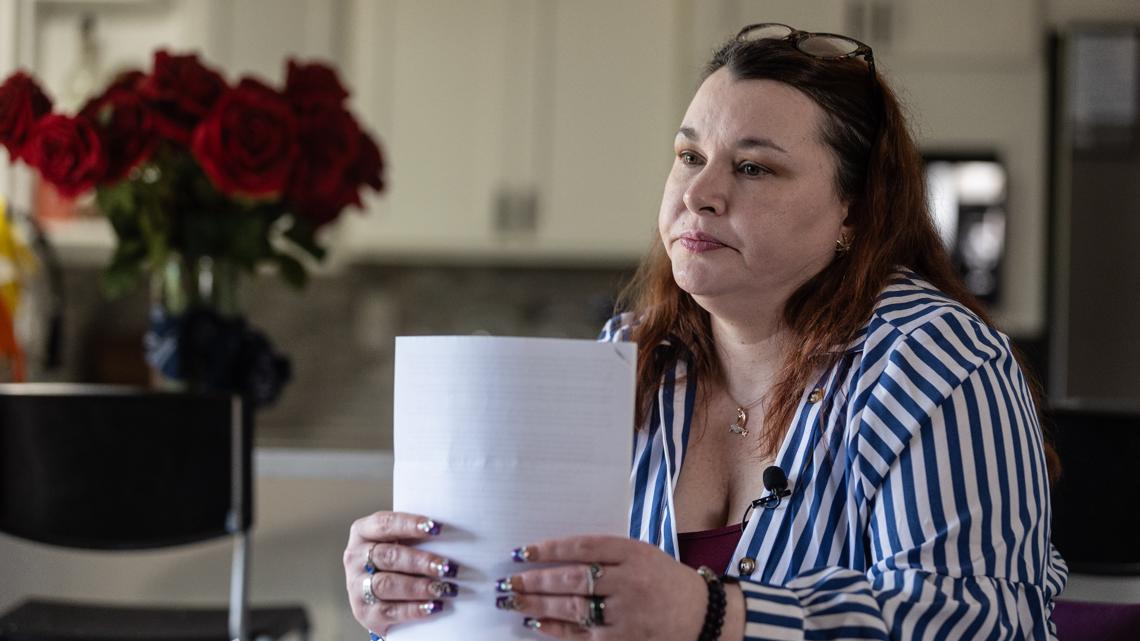

“This feels mobster. Cut off everything you have?” said Jennifer DeWitt. "That’s a lot for water."

The unpaid bill dates to 2022, when DeWitt and her husband Brent moved out of their rental home. Records show they owed the Portland Water Bureau roughly $1,100.

“We just didn’t have money to fight it at the time,” said DeWitt. “We figured we’ll just take a hit on our credit. When we break even, we’ll start digging ourselves back out like we always do.”

The couple knew the unpaid bill would end up in collections, and it did — racking up interest and fees. But then, the unexpected happened. In May, Brent discovered he couldn’t access any money to put gas in the car.

“How can my accounts be frozen?” Brent asked.

His bank warned that the family’s funds were on hold, including those for Brent’s disabled mother and adult daughter. Their money was frozen too because Brent and his wife are connected to their bank accounts.

“I wasn’t aware something like this could happen over a water bill,” said Jennifer. “Just frozen! We cannot touch it whatsoever. We have no access to our money.”

As it turned out, a private debt collector contracted by the city, Ray Klein Inc. or Professional Credit Services, tried to garnish the DeWitts' bank accounts to pay off that old water bill. The banks had frozen the accounts while processing payment. There was no warning from the debt collector or the bank. And the city was no help — claiming it was out of their hands.

“We have emailed, called, paper mailed all of these offices begging for- 'Please don’t do this to us,'” said Jennifer.

RELATED: City of Portland sent evicted homeowner to collections over unpaid water bill, sued him twice

Despite working a full-time job, Brent couldn’t access his paycheck because it was directly deposited into a bank account that was frozen.

The Portland family and their extended family couldn’t access money to buy food or pay bills for weeks.

To financially survive, Brent donated plasma for money while Jennifer did DoorDash food delivery.

“That’s the only money we can get to eat,” explained Jennifer.

In a series of reports over the past few years called "The Cost of Collections", KGW has examined the aggressive tactics used by city hall to force people to pay up, and how the punitive nature of debt collection may be undermining Portland’s own effort to keep residents housed, employed and able to meet their essential needs.

“I don’t understand — why keep squeezing us until we lose everything. Is that really necessary?” asked Jennifer.

The city of Portland regularly turns delinquent water bills over to a private debt collector, which uses methods like lawsuits and garnishment of wages to collect debts.

From 2017 to March 2024, the Water Bureau sent more than 16,000 delinquent accounts to collections. In all, the unpaid bills totaled more than $15.7 million. Of the delinquent funds, roughly 18% was recovered.

Which raises the question: Is it worth it? Wreaking havoc on the lives of people who owe old water bills by sending them to collections — only to recover a small portion of what’s owed.

In 2022, city auditors questioned how various bureaus, including the water bureau, collected money. The audit recommended a more consistent and thoughtful process in sending people to collections. A follow-up report found those citywide recommendations were not implemented.

KGW requested an interview with director Gabe Solmer about the water bureau’s use of a third-party debt collector. After three weeks of repeated emails and phone calls, the water bureau’s director declined to speak with us or address the harmful impact of debt collection on Portland families.

There are alternatives. Some cities have created amnesty programs, which provide debt forgiveness to low-income households. The city could restrict debt collection activities, including limiting how or when accounts are turned over to collections. Local government could create an office for people with issues dealing with a debt collection agency involving city accounts. During the pandemic, the city of Portland stopped sending people to collections and didn’t allow garnishment of wages for utility bills.

According to its website, the water bureau works to help people who fall behind on their water bill by providing resources, offering payment plans or directing customers to a financial assistance program.

“Even when we don’t receive payment, we make multiple attempts to reach out via letter, phone, and email, so that we can work together towards a solution,” wrote bureau spokesperson Brandon Zero in an email to KGW. “We are dedicated to taking early and ongoing actions to encourage voluntary payment and avoid the need for collections whenever possible.”

But, after a final bill is generated and a delinquent account is sent to a third-party debt collector, the city takes a hands-off approach.

Next January, a new Oregon law takes effect providing protections against unfair debt collections. The Family Financial Protection Bill keeps debt collectors from wiping out someone’s bank account, helps protect wages from being garnished and prevents people from losing their home during debt collections.

RELATED: ‘It is like robbery’: A debt collector wrongly wiped out an Oregon man’s entire bank account

In Oregon, 680,000 people have debt that’s been turned over to collections, according to the Urban Institute, a nonprofit research organization. That’s 16% of the state’s population.

Four weeks after their accounts were frozen, the DeWitts finally got access to their money after the debt collector garnished the amount owed, along with penalties and interest.

This family understands the city’s need to fund the services it provides but feels it should do so fairly and not cause harm to the people it serves — arguing there should be limits on how far the city will go to try and collect an overdue water bill.

“I’m heartbroken that this is over water,” explained Jennifer. “This is water.”