SALEM, Ore. — Oregon's projected 2024 kicker just can't seem to stop growing. The record-breaking kicker fund had already risen from roughly $3 billion in May 2022 to $5.5 billion a year later, and the latest forecast released Wednesday kicked it up another notch to $5.6 billion.

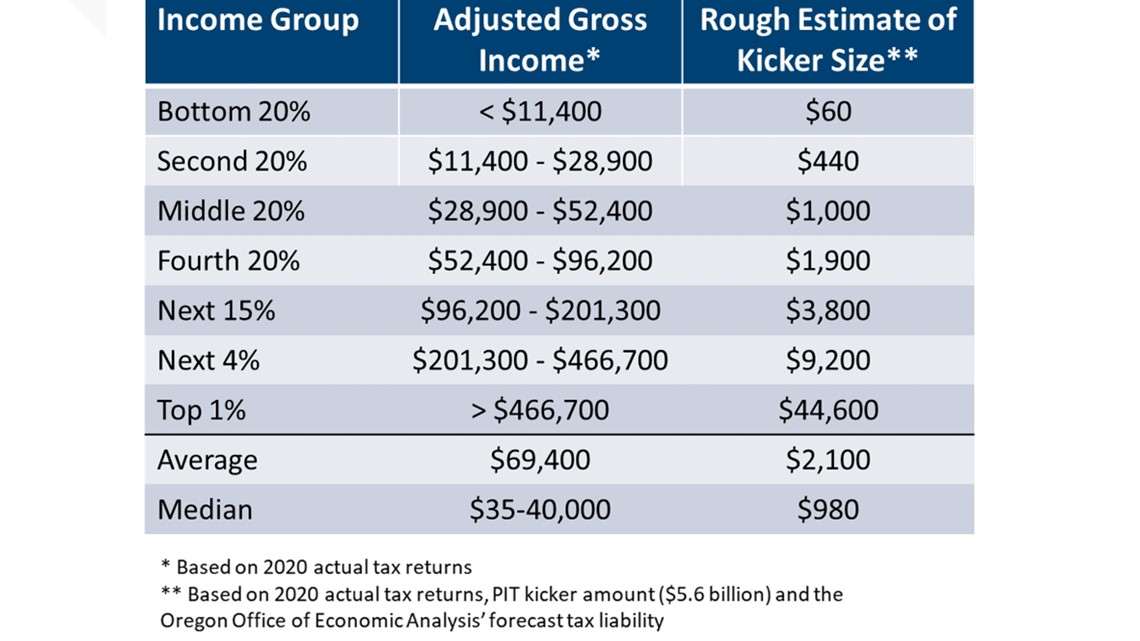

The median Oregonian is now set to receive a $980 rebate when they file their taxes next year, according to the forecast from state economists, with an average kicker of about $2,100. The highest average kicker currently on record is $914 send back in 2020, although the average kicker sent back in 2022 was likely a bit higher based on the surplus for that biennium.

Since the kicker is proportional to income tax liability, higher-earning Oregonians are set to receive far more money back next year. The report includes a breakdown of expected kicker amounts broken down by income bracket, calculated as a rough estimate using 2020 tax data:

The latest kicker fund bump stems from a larger ending balance than previously expected, now that the state's accountants are closing the books on the 2021-23 biennium, according to the report.

Oregon's kicker rebate goes out during even-numbered years — when Oregonians file their taxes for the preceding odd-numbered year — due to the state's two-year budget cycle. In some years it may not go out at all; the rebate only kicks in when general fund revenues at the end of the biennium turn out to be at least 2% higher than the state's economic forecasters predicted at the start of the cycle.

The forecast also shows a $437 million increase in projected general fund resources for the 2023-25 biennium compared to the previous forecast in June. The new economic forecast offers a "close-of-session" report that incorporates any changes enacted during the 2023 legislative session and offers a final look at the previous biennium, which also concluded in June.

Legislative changes reduced projected general fund revenue for the new biennium by about $48.6 million, according to the report, but the state continued to benefit from larger-than-expected revenue from corporate income taxes, which is responsible for most of the $437 million net increase.

Oregon's overall economic outlook is essentially the same as it was in June, according to the forecast report. Projected revenue has risen slightly because the economy is still in an "inflationary boom" with growth outpacing expectations, but the pace of inflation has slowed in the past year. The state's labor market has loosened a bit but remains tight.