VANCOUVER, Wash. — Anyone who's attempted or succeeded in buying a home knows how difficult it can be to set aside money for a down payment. As housing prices continue to rise, it can take years to save up enough for a 20% down payment on a mortgage loan.

Clark County is rolling out a new effort to help make the homeowner dream a reality for some residents who are struggling to get there. It's called the Homebuyer Down Payment Assistance Program.

Clark County treasurer Alishia Topper said she's been working to create the program for the past couple of years, after seeing initiatives launched in other counties in Washington state.

"As I started seeing housing prices increase here in Clark County and across our region, I started seeing our lower income and moderate income not being able to qualify," Topper said.

Home prices in Clark County over the past 12 months have risen 9.4 percent, she said, but the median price of a home is down below $600,000.

Topper worked with the Washington State Housing Finance Commission and the Clark County council to find the $2.6 million in funding. $2 million will come from the millions in state and local relief funds given to the county, and the other $600,000 was matched by the Housing Commission.

"I think this will have a significant impact in an ability to buy a home," Topper said.

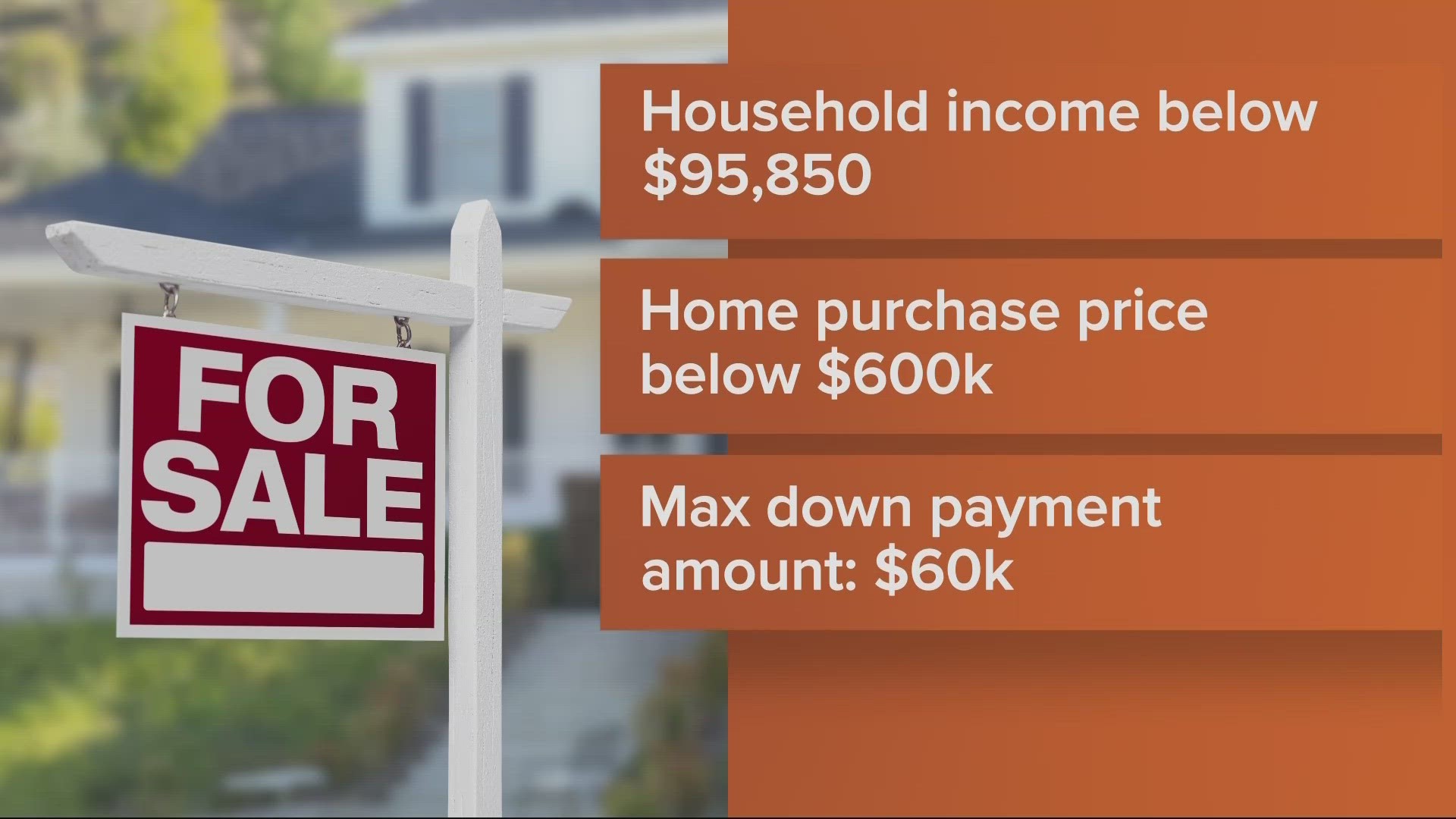

Potential homebuyers would need to meet several requirements in order to qualify for a loan from the program, including having a household income below $95,980 and a home purchase price of less than $600,000.

The maximum amount the county will loan out would be $60,000 per person, and Topper said that amount is based on household income. The home in question must be purchased in Clark County, and it must become the buyers' primary residence.

"$60,000 will be able to offer an opportunity (to people) who otherwise wouldn't be able to imagine or ever have the dream of owning their own home," she said. "Ultimately the program is hopefully going to achieve an opportunity for first time homebuyers to gain generational wealth that they then can build on and pass on to their family."

The money isn't free; recipients will need to pay back their loans at a 2% interest rate, although they won't need to worry about juggling payments on the down payment loan and their regular mortgage at the same time.

"You don't have to make a payments until you sell your home, you refinance or you pay off your mortgage in 30 years. So there's no monthly payments, which will keep that monthly cost affordable for these new home owners," Topper said.

Eligible homebuyers can work with a lender to get prequalified for a Housing Finance Commission home loan. When they're ready to buy, the lender can reserve the down payment assistance along with the home loan.

Potential recipients also need to first sign up for more information on the county's website and then enroll in a homebuyer's education class and take a one-on-one pre-purchase counseling session.

For more information on the program and to see if you qualify, visit Clark.WA.gov/treasurer and click on the Home Buyer Down Payment Assistance menu option on the left side of the webpage.