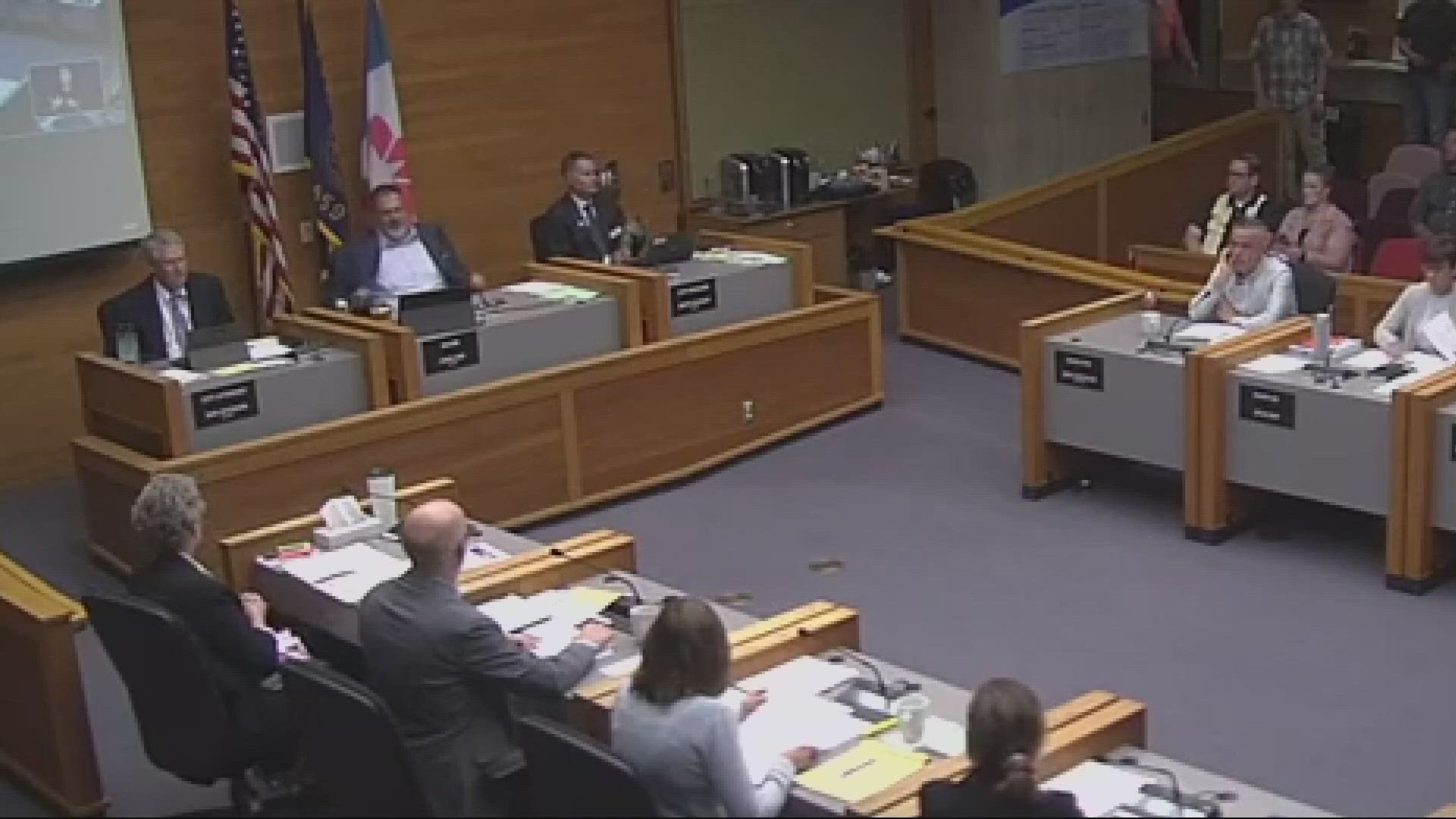

SALEM, Ore. — Despite opposition from many Salem workers, the Salem City Council approved a payroll tax of Salem workers.

The tax is a .814% tax on earnings of all workers, except for those making minimum wage. For someone making $50,000 a year, the additional tax will cost them around $400.

"I think this tax is not right," Keizer Resident Tom Rohlfing said.

The tax does not just affect Salem residents, but anyone working within the city.

"What might seem like a small tax to you is the difference between medicine, rent and food," Salem Resident Riley Harrigan said.

Salem Mayor Chris Hoy said the city had no choice, but to add the additional tax.

"The thing is, we've been cutting for decades,” Hoy said. “We've been cutting and cutting, and we can't cut anymore."

Salem City Manager Keith Stahley said the payroll tax will allow Salem to expand, and maintain, police and fire department resources.

"Basically, our staffing right now is at 2008 levels,” Hoy said. “And we've added 26,000 residents in that span of time."

Hoy said the tax will generate $29 million annually. In 2031, the tax will be referred to voters, who could then sunset the tax. But Hoy said the city council could refer it to voters sooner.

Besides police and the fire department, funds will also be used for homeless services, paying for three micro-shelter communities and a navigation center.

The navigation center will have 75 beds and serve Salem’s homeless population 24/7.

"If we didn't do this, we'd have to close our library, stop park services, close our senior center,” Hoy said. “And then we'd still have to cut money from the police and fire budget."

Workers said Salem residents should have been able to vote on the tax, instead of it being decided by the city council.

"Your proposal to pass this ordinance without sending it to the voters is quite frankly cowardly and shameful," Salem Resident Margaret May said.