Voter Guide 2020: Measures on the ballot in Oregon

Ballot measure topics on the Oregon and Portland metro ballot include legalizing psilocybin therapy, taxing vape products and free preschool.

Ballot measures in Oregon for the 2020 general election cover wide-ranging topics, from legalizing psilocybin in controlled settings statewide to providing free preschool to all children in Multnomah County.

Here's a look at the four measures that will appear on the ballot for everyone in Oregon, as well as measures that people in the Portland metro area will get a chance to vote on.

Washington voters: Get info here on the 2020 general election

The official state and county voting guides were mailed out to voters starting on Oct. 5.

VOTER GUIDE 2020: Candidates on the ballot in Oregon's November general election

VOTER GUIDE 2020: Everything you need to know about voting in Oregon

What questions do you have about the election? Submit them here!

Campaign spending

Oregon Measure 107

Amends Constitution: Allows laws limiting political campaign contributions and expenditures, requiring disclosure of political campaign contributions and expenditures, and requiring political campaign advertisements to identify who paid for them

Result of “Yes” Vote: “Yes” vote allows laws, created by the Legislative Assembly, local governments or voters that limit contributions and expenditures made to influence an election. Allows laws that require disclosure of contributions and expenditures made to influence an election. Allows laws that require campaign or election advertisements to identify who paid for them. Campaign contribution limits cannot prevent effective advocacy. Applies to laws enacted or approved on or after January 1, 2016.

Result of “No” Vote: “No” vote retains current law. Courts currently find the Oregon Constitution does not allow laws limiting campaign expenditures. Laws limiting contributions are allowed if the text of the law does not target expression.

Summary: The Oregon Supreme Court has interpreted the Oregon Constitution to prohibit limits on expenditures made in connection with a political campaign or to influence the outcome of an election. Limits on contributions are allowed if the text of the law does not target expression. The proposed measure amends the Oregon Constitution to allow the Oregon Legislative Assembly, local governments, and the voters by initiative to pass laws that limit contributions and expenditures made in connection with a political campaign and contributions and expenditures made to influence an election. The measure would allow laws that require disclosure of political campaign and election contributions and expenditures. The measure would allow laws that require political campaign and election advertisements to identify who paid for them. Laws limiting campaign contributions cannot prevent effective advocacy. Measure applies to all laws enacted or approved on or after January 1, 2016.

Financial Impact Statement:

This measure will have no financial effect on the expenditures or revenues of the state, counties, cities, or special districts in Oregon.

Committee Members:

- Secretary of State Bev Clarno

- State Treasurer Tobias Read

- Katy Coba, Director, Department of Administrative Services

- Betsy Imholt, Acting Director, Department of Revenue

- Tim Collier, Local Government Representative

(The estimate of financial impact was provided by the above committee pursuant to ORS 250.127.)

Read the full text of Measure 107

Tobacco tax

Oregon Measure 108

Increases cigarette and cigar taxes. Establishes tax on e-cigarettes and nicotine vaping devices. Funds health programs.

Result of “Yes” Vote: "Yes" vote increases cigarette tax by $2 per pack. Increases cap on cigar taxes to $1 per cigar. Establishes tax on nicotine inhalant delivery systems, such as e-cigarettes and vaping products. Funds health programs. Approves other provisions.

Result of “No” Vote: "No" vote retains current law. Cigarettes are taxed at current rate of $1.33 per pack. Tax on cigars is capped at 50 cents per cigar. Nicotine inhalant delivery systems, such as e-cigarettes and vaping products, remain untaxed.

Summary: Under current law, a tax of $1.33 is imposed on each pack of 20 cigarettes, cigars are taxed at 65 percent of the wholesale price, up to a maximum of 50 cents per cigar, and nicotine inhalant delivery systems, such as e-cigarettes and vaping products, are not taxed. Measure increases the cigarette tax by $2 per pack and increases the maximum tax on cigars to $1 per cigar. Measure provides for smaller cigars (sold commonly as "cigarillos") to be taxed like cigarettes. Measure establishes tax on nicotine inhalant delivery systems, such as e-cigarettes and vaping products, at 65 percent of the wholesale price. Tax on nicotine inhalant delivery systems does not apply to approved tobacco cessation products or to marijuana inhalant delivery systems. Revenue from increased and new taxes will be used to fund health care coverage for low-income families, including mental health services, and to fund public health programs, including prevention and cessation programs, addressing tobacco- and nicotine-related diseases.

Financial Impact Statement:

This referral increases taxes on cigarettes and cigars and establishes a tax on e-cigarettes and vaping devices and dedicates the revenues to health programs at the Oregon Health Authority. The measure will increase net state revenues by $111.1 million in 2019-21 and $331.4 million in 2021-23. The measure dedicates 90 percent of the revenue from the increased cigarette tax and the e-cigarette and vaping device tax to support the Oregon Health Plan and other medical assistance programs and 10 percent to tobacco use prevention and cessation programs. Funds spent on the Oregon Health Plan are eligible for federal matching funds. The direct expenditure impact of the measure is the cost of administering the tax increases, estimated at $1.0 million in 2019-21 and $1.3 million in 2021-23.

Local governments, the state’s General Fund, and mental health programs at the Oregon Health Authority could see a decline in revenue if the measure passes. The current cigarette tax and the proposed tax are dedicated to different purposes.

Beyond the cost of administration, the impact of the revenue increases and decreases on state and local government expenditures is indeterminate and will depend on decisions made by the governing bodies of those governments.

Committee Members:

- Secretary of State Bev Clarno

- State Treasurer Tobias Read

- Katy Coba, Director, Department of Administrative Services

- Betsy Imholt, Acting Director, Department of Revenue

- Tim Collier, Local Government Representative

(The estimate of financial impact was provided by the above committee pursuant to ORS 250.127.)

Read the full text of Measure 108

Legalized psilocybin

Oregon Measure 109

Allows manufacture, delivery, administration of psilocybin at supervised, licensed facilities; imposes two-year development period

Result of “Yes” Vote: Allows manufacture, delivery, administration of psilocybin (psychoactive mushroom) at supervised, licensed facilities; imposes two-year development period. Creates enforcement/taxation system, advisory board, administration fund.

Result of “No” Vote: "No" vote retains current law, which prohibits manufacture, delivery, and possession of psilocybin and imposes misdemeanor or felony criminal penalties.

Summary: Currently, federal and state laws prohibit the manufacture, delivery, and possession of psilocybin (psychoactive mushroom). Initiative amends state law to require Oregon Health Authority (OHA) to establish Oregon Psilocybin Services Program to allow licensed/regulated production, processing, delivery, possession of psilocybin exclusively for administration of “psilocybin services” (defined) by licensed “facilitator” (defined) to “qualified client” (defined). Grants OHA authority to implement, administer, and enforce program. Imposes two-year development period before implementation of program. Establishes fund for program administration and governor-appointed advisory board that must initially include one measure sponsor; members are compensated. Imposes packaging, labeling, and dosage requirements. Requires sales tax for retail psilocybin. Preempts local laws inconsistent with program except “reasonable regulations” (defined). Exempts licensed/regulated activities from criminal penalties. Other provisions.

Financial Impact Statement:

This measure will have no financial effect on the expenditures or revenues of the state, counties, cities, or special districts in Oregon.

Committee Members:

- Secretary of State Bev Clarno

- State Treasurer Tobias Read

- Katy Coba, Director, Department of Administrative Services

- Betsy Imholt, Acting Director, Department of Revenue

- Tim Collier, Local Government Representative

(The estimate of financial impact was provided by the above committee pursuant to ORS 250.127.)

Read the full text of Measure 109

Addiction services

Oregon Measure 110

Provides statewide addiction/recovery services; marijuana taxes partially finance; reclassifies possession/penalties for specified drugs

Result of “Yes” Vote: “Yes” vote provides addiction recovery centers/services; marijuana taxes partially finance (reduces revenues for other purposes); reclassifies possession of specified drugs, reduces penalties; requires audits.

Result of “No” Vote: "No" vote rejects requiring addiction recovery centers/services; retains current marijuana tax revenue uses; maintains current classifications/ penalties for possession of drugs.

Summary: Measure mandates establishment/ funding of “addiction recovery centers” (centers) within each existing coordinated care organization service area by October 1, 2021; centers provide drug users with triage, health assessments, treatment, recovery services. To fund centers, measure dedicates all marijuana tax revenue above $11,250,000 quarterly, legislative appropriations, and any savings from reductions in arrests, incarceration, supervision resulting from the measure. Reduces marijuana tax revenue for other uses. Measure reclassifies personal non-commercial possession of certain drugs under specified amount from misdemeanor or felony (depending on person’s criminal history) to Class E violation subject to either $100 fine or a completed health assessment by center. Oregon Health Authority establishes council to distribute funds/ oversee implementation of centers. Secretary of State audits biennially. Other provisions.

Financial Impact Statement:

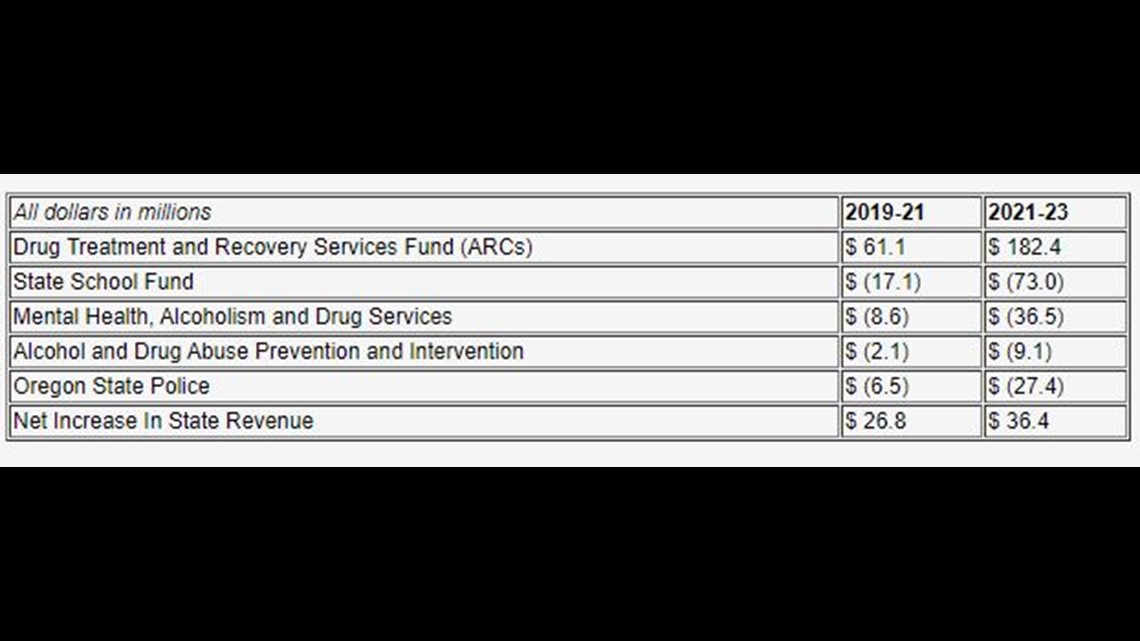

The initiative directs the Oregon Health Authority (OHA) to establish Addiction Recovery Centers and increase funding for other substance use disorder services offset by decreasing funding to other programs, changes the distribution of marijuana tax revenues and reduces drug penalties for possession of some drugs.

Marijuana Revenue Redistribution

The initiative creates the Drug Treatment and Recovery Services Fund (DTRSF). It redistributes marijuana revenue above $11.25 million per quarter from existing recipients to the DTRSF, reducing revenue to the State School Fund, the State Police, mental health programs, and local governments. The revenue redistributions for state agency programs are summarized below:

OHA is directed to administer grants to fund the Addiction Recovery Centers (ARCs), which will offer 24 hour access to care every day of the year starting October 1, 2021. The grants will be awarded to ARCs for operational expenses as well as to organizations providing substance use disorder treatment, peer support and recovery services, permanent supportive housing, and harm reduction interventions to be provided free of charge to the recipient of the services.

The initiative requires the Legislature to provide $57 million in annual funding (with increases for inflation) for the DTRSF. Marijuana revenue estimated at $61.1 million in 2019-21 and $182.4 million in 2021-23 should be sufficient to meet this requirement.

The initiative reduces the marijuana revenue distribution to cities and counties. The total reduction is $8.6 million in 2019-21 and $36.4 million in 2021-23.

Decriminalization of Certain Drug Offenses

The initiative decriminalizes certain drug offenses and transfers the savings due to lower spending on arrests, probation supervisions and incarcerations to the DTRSF to fund additional ARC expenditures. These savings are estimated at $0.3 million in 2019-21 and $24.5 million in 2021-23. This will reduce revenue transferred from the Department of Corrections for local government community corrections by $0.3 million in 2019-21 and $24.5 million in 2021-23. The savings are expected to increase beyond the 2021-23 biennium.

Committee Members:

- Secretary of State Bev Clarno

- State Treasurer Tobias Read

- Katy Coba, Director, Department of Administrative Services

- Betsy Imholt, Acting Director, Department of Revenue

- Tim Collier, Local Government Representative

(The estimate of financial impact was provided by the above committee pursuant to ORS 250.127.)

Read the full text of Measure 110

Library bond

Multnomah County Measure 26-211

Bonds to Expand, Renovate, Construct Library Branches, Facilities; Increase Safety

Question:

Shall County expand, modernize, rebuild, acquire land for library facilities; issue $387,000,000 in general obligation bonds, with oversight, audits? If the bonds are approved, they will be payable from taxes on property or property ownership that are not subject to the limits of sections 11 and 11b, Article XI of the Oregon Constitution.

Summary:

If approved, this measure would authorize up to $387,000,000 of general obligation bonds to finance capital costs to increase the size and update library facilities across the County. Specifically, the bonds are intended to:

- Enlarge and modernize eight county libraries, some in each part of the county

- Build a flagship library in East County, similar in capacity to downtown’s Central Library

- Expand, renovate, or construct seven branch libraries, including Albina, Belmont, Holgate, Midland, North Portland, Northwest, and St. Johns

- Add gigabit speed internet to all libraries

- Create a central materials handling and distribution center to increase efficiency and cost effectiveness

- Pay for furnishings, equipment, site improvements, land acquisition, and bond issuance costs

Financial impact:

Bonds would mature not more than nine years from issuance and may be issued in multiple series. The County estimates the average cost to be $0.61 per $1,000 of assessed value over the term of the bond. Actual rate may vary. An independent bond oversight committee and annual audits will help ensure funds are used as intended.

Free pre-school for all

Multnomah County Measure 26-214

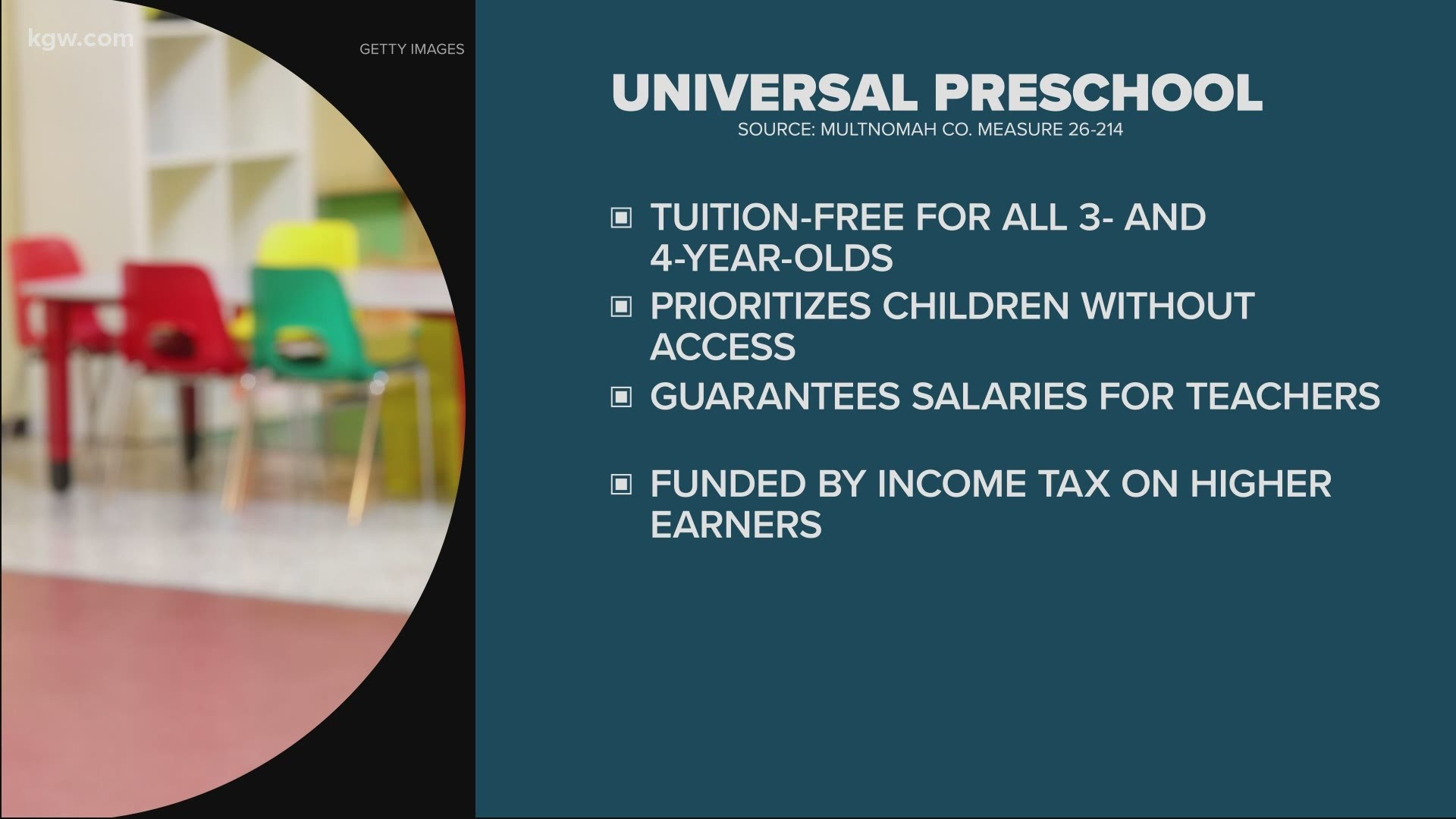

Establishes tuition-free preschool program, higher earners income tax funding

Question:

Should County establish tuition-free “Preschool for All Program” with new 1.5 to 3.8 percent tax on income above thresholds?

Summary:

Establishes “Preschool for All Program” providing up to six hours per day of tuition-free, developmentally appropriate early learning, reflecting best practices. Mixed delivery model; half-day, full-day, year-round, school-year schedule options. All three, four year olds with parent, legal guardian residing in County eligible. Equitable access provided to people of color, historically marginalized communities. Before, aftercare for qualifying incomes. Board to establish provider credentialing requirements, compensation matrix including teacher pay on par with kindergarten teachers, assistants paid $19.91 per hour in 2022 with adjustments. County neutral on representation, collective bargaining on provider labor relations.

Financial impact:

New tax on county residents and taxable income derived within County funds Program: 1.5 percent tax on taxable income over $125,000 (single) and $200,000 (joint), increasing to 2.3 percent tax January 1, 2026; additional 1.5 percent tax on taxable income over $250,000 (single) and $400,000 (joint) .

Administration by Department of County Human Services (Program), Chief Financial Officer (Tax). Establishes Board appointed advisory committee for oversight, policy recommendations. Independent performance audits. Other provisions.

Portland parks levy

Portland Measure 26-213

Restore recreation programs, parks, nature, water through five-year levy

Question:

Shall Portland protect, restore recreation programs, parks, nature, clean water; 5-year operating levy, $0.80 per $1,000 assessed value, beginning 2021? This measure may cause property taxes to increase more than three percent.

Summary:

Levy will prevent ongoing reductions to park services and recreation programs, preserve and restore park and natural area health, and center equity and affordable access for all. Levy funds will:

- Enhance and preserve parks, rivers, wetlands, trees, and other important natural features in urban areas for the benefit of all Portlanders and wildlife

- Provide park and recreation services to diverse populations including communities of color, seniors, teens, households experiencing poverty, immigrants and refugees, and people living with disabilities

- Increase opportunities for communities of color and children experiencing poverty to connect with nature

- Prevent cuts to recreation programs, closures of community centers and pools

- Enhance park maintenance to keep parks clean and safe, including litter and hazardous waste removal, restroom cleaning, and playground safety.

If levy fails, service improvements and restoration described above will not occur; taxes will not increase. A five-member oversight committee will review levy expenditures, provide annual reports. Independent audit required.

Financial impact:

Levy is $0.80 per $1,000 assessed home value. The proposed rate will raise approximately $44,735,000, in 2021-2022, $46,240,000 in 2022-2023, $47,705,000 in 2023-2024, $49,262,000 in 2024-2025, and $51,135,000 in 2025-2026, for a total of $239,078,000.

A median residential homeowner pays $151 per year, or about $13 per month.

Police oversight board

Portland Measure 26-217

Amends Charter: Authorizes new, independent community police oversight board

Question:

Shall Charter be amended to authorize new, independent community police oversight board to investigate complaints against Portland Police, impose discipline?

Summary:

The measure adds a Charter section authorizing an independent police oversight board appointed by City Council.

Board Membership:

- Members from diverse communities, particularly those with lived experience of systemic racism and those who have experienced mental illness, addiction, or alcoholism

- Shall not include current law enforcement employees and immediate family members or former law enforcement employees

- Board size, members’ terms, term limits to be determined by City Code

Board Budget:

- Shall be no less than 5% of the Police Bureau’s operating budget

Board Staff:

- Board shall appoint a Director who serves at the pleasure of Board and who appoints staff and investigators.

Board Powers and Duties:

- Investigate all deaths in custody, uses of deadly force, complaints of force causing injury, discrimination against protected classes, constitutional rights violations

- Investigate complaints

- Subpoena documents

- Access police records

- Compel witness statements, including from police officers

- Impose discipline, including termination

- Recommend policies focused on community concerns to Police Bureau, City Council

- Powers restricted by State, Federal laws

- Remove barriers for members’ participation

Other provisions to be established by City Code.

Water Fund spending

Portland Measure 26-219

Amends Charter: Authorizes new Water Fund spending; addresses land use

Question:

Shall Charter allow Water Fund to finance incidental public uses of certain Water Bureau lands, and explicitly authorize these uses?

Summary:

The Water Fund is funded by water service ratepayers and used only to pay costs of providing water service.

A judge recently found that the City Charter does not authorize City Council to spend Water Fund monies on any uses of Water Bureau land not “reasonably related” to providing water service to residents.

Measure would amend the Charter to state explicitly that Council may spend Water Fund monies on general public “incidental uses” (undefined) of Water Bureau lands other than the Bull Run Watershed Closure Area. Measure would allow Council to raise water rates to pay for costs created by such incidental uses.

Measure would also amend the Charter to state explicitly that Council may permit or prohibit such uses.

Incidental uses may include neighborhood green spaces and community gardens. Current examples of such uses include recreational uses of Dodge Park, Powell Butte Nature Park, and other “HydroParks.”

Costs related to incidental public uses may include maintaining the lands and facilities, and ensuring compliance with state and federal laws, including the Americans with Disabilities Act.

Transportation tax

Metro Measure 26-218

Funds traffic, safety, transit improvements, programs through tax on employers

Question:

Should Metro fund roads, transit, safety improvements, bridge repair, transportation programs by establishing tax on certain employers (0.75% of payroll)?

Summary:

Funds traffic, safety, and transit improvements and transportation programs along roadway and transit corridors in Clackamas, Multnomah, Washington counties within district boundary. Revenue to supplement other transportation funding.

Improvements and programs funded by tax on certain employers; tax rate not to exceed 0.75% of payroll. Tax exempts employers with 25 or fewer employees, state and local governments. Metro may set tax rate lower than 0.75% of wages and increase not more than once per fiscal year up to 0.75%. Tax effective beginning 2022.

Identifies 17 corridors for transportation improvements with approximately 150 projects that prioritize traffic safety, transit efficiency, mobility, and reliability for all modes on roads and transit corridors. Metro to develop agreements with partner agencies responsible for delivery of projects. Improvements include:

- Rapid bus network

- Light-rail transit line

- Bridge repair, replacement

- Sidewalks, pedestrian crossings

- Signal upgrades

Identifies 10 programs that prioritize safety, access to transit, racial equity, and community stability. Requirements for public engagement, accountability, and fiscal transparency in implementation.

Establishes independent oversight committee to evaluate progress and implementation. Requires independent financial audits.

School improvement bond

Portland schools Measure 26-215

Bonds to Improve Health, Safety, Learning by Modernizing, Repairing Schools

Question:

Shall Portland Public Schools repair, modernize schools; replace technology, curriculum; by issuing bonds estimated to maintain current tax rate?

If the bonds are approved, they will be payable from taxes on property or property ownership that are not subject to the limits of sections 11 and 11b, Article XI of the Oregon Constitution.

Summary:

Measure authorizes up to $1.208 billion in principal amount of general obligation bonds for facilities and education investments. Measure is not expected to increase tax rates above previous targets, because debt service is scheduled to decline.

If approved, this measure would finance capital costs, including projects that:

- Provide curriculum materials, technology, accessibility improvements

- Repair/replace roofs, mechanical systems

- Renovate/replace schools, including Jefferson, Benson, a facility for alternative school programs; design renovation/replacement of Cleveland and Wilson; plan and add additional capacity

- Develop a culturally-responsive community plan, make targeted investments in facilities in North/Northeast Portland

- Strengthen building security; seismic safety.

Requires citizen accountability/oversight; independent audits of projects and expenditures. Bonds may be issued in one or more series, with each series maturing in 30 years or less.

Financial impact:

Due to declining debt service, measure is not expected to increase PPS’s bond tax rate above $2.50/$1,000 assessed value, the same rate that has been targeted since the 2017 bond issue. Actual rates may differ based on interest rates and changes in assessed value.

Other ballot measures

Other measures on the ballot statewide and in the Portland metro area:

Riverdale School District

- Ballot Measure 26-216 - Five-Year Local Option Tax For District Operations

City of Troutdale

- Ballot Measure 26-212 - Amends charter: city councilor candidates run against all councilor candidates

Corbett School District

- Ballot Measure 26-220 - Bonds to Construct, Renovate, and Improve District Facilities

Clackamas Fire District

- Ballot Measure 3-560 - Merge Estacada Fire District #69 with Clackamas Fire District #1

Linn County

- Ballot Measure 22-183 - Four Year Law Enforcement Local Option Tax Levy

Coos County

- Ballot Measure 6-185 - Measure authorizing Charleston Area tax on short-term lodging

Visit the Oregon Secretary of State voting guide for a deeper look into statewide ballot measures, including explanatory statements, political party statement and arguments for and against each measure.

To see the arguments for and against Portland metro area ballot measures, visit the Multnomah County military/overseas voting guide.

If you have questions about ballot measures not listed above, visit this guide to contact elections officials in your county.