OLYMPIA, Wash. — Three states that would be affected by a proposed 6-cent per gallon tax on fuel exported from Washington state are pushing back on the plan, and threatening to retaliate if it is signed into law.

The tax — part of a $16.8 billion transportation revenue package that has cleared the state Senate and is working its way through the House — is projected to raise billions over the course of 16 years.

Ninety percent of the refined petroleum used in Oregon is imported from Washington, according to the U.S. Energy Information Administration. Idaho has a more diverse array of sources, but has no refineries. Alaska, meanwhile, is the second-most petroleum-dependent state in the country, behind only Hawaii, and exports much of its crude oil.

The Seattle Times reports lawmakers from Alaska, Oregon and Idaho are strongly opposed to the move, and making their feelings known through resolutions, calls and op-eds.

“Washington taking unilateral action to increase gas prices for Oregon families and businesses is unacceptable,” Oregon Gov. Kate Brown said in a tweet last week.

Brown, who said she conveyed her displeasure to Washington Gov. Jay Inslee in a phone call last week, wrote an an op-ed Tuesday urging him to “put this bad idea back on the shelf, where it belongs.”

Alaska Gov. Mike Dunleavy encouraged his constituents to call Inslee’s office to oppose the tax, and the Idaho House of Representatives on Tuesday unanimously approved a joint memorial calling on Inslee to veto the tax if it comes to his desk, warning that the Legislature “will take any and all actions necessary to block this new tax,”

Idaho’s governor and attorney general also asked Inslee in a letter to veto the tax.

Jaime Smith, a spokeswoman for Inslee, said that the Democratic governor will sign the transportation revenue package if it makes it to his desk.

“Funding sources are always a point of debate, and this plan is no different,” Smith said.

The tax would apply to any fuel products exported from Washington’s five refineries, which have historically been exempt from the state’s gas tax. Lawmakers say the new revenue stream was needed in order to not raise the state's gas tax.

Washington has the fifth-largest crude oil refining capacity in the country. Democratic Sen. Marko Liias, chair of the Senate Transportation Committee, and other Democrats argue the tax would help spread out the environmental burden caused by Washington’s refineries.

“This is a modest cost that has a huge return on investment, both for our state but also for our partner states,” Liias said. As for the threats from neighboring states, Liias said, “I think a lot of it is rhetoric.”

"There are about 80,000 people in my county that go across the old bridge to work in Oregon and every one of the pays about 10% Oregon income tax. Having both states pay for a little bit of infrastructure makes a whole lot of sense," said House Transportation Committee Vice Chair Sharon Wylie, a Democrat.

Wylie referred to the Interstate Bridge Replacement Program (IBR), which has indicated it will need upwards of a billion dollars from Oregon and Washington to build the bridge. The proposed bill does not specifically name IBR as a recipient, but it might be on the receiving end of the state funds.

In Alaska, Republican Rep. Kevin McCabe, is proposing a set of retaliatory taxes if Washington’s goes into effect — 6-cents per pound of exported fish; a 6-cent per-foot mooring fee; and a $15 per-barrel surcharge on crude oil sent to Washington for refining.

“I want people in Washington to understand that Alaska is not going to take this taxation without representation lying down,” McCabe said.

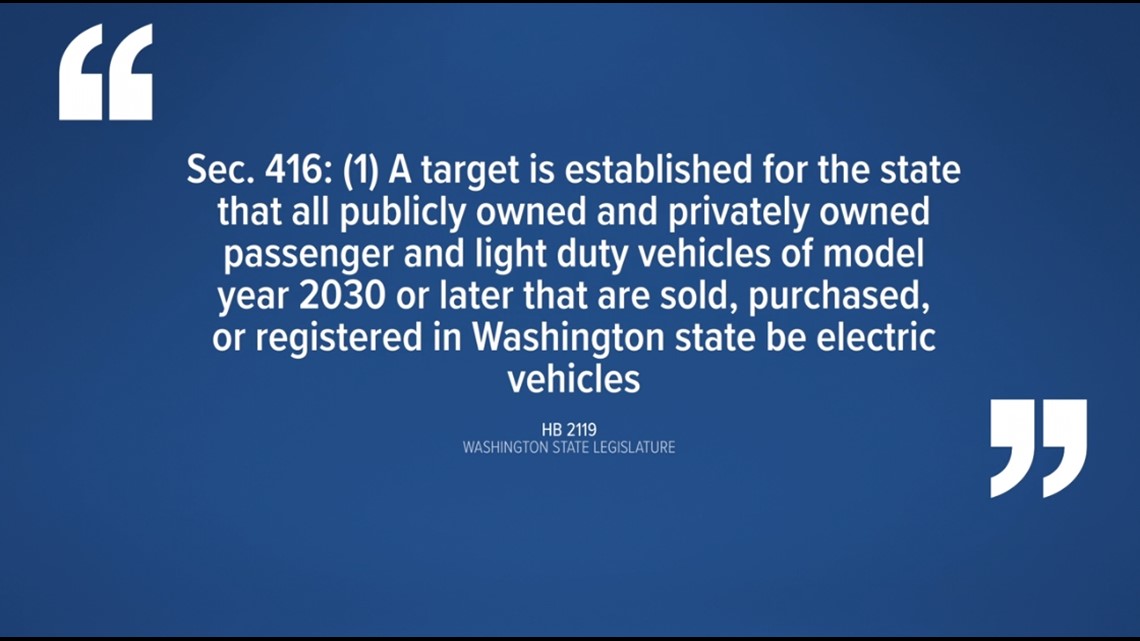

Another opponent to the bill is the Affordable Fuel Washington Coalition. They're most concerned with another provision with HB 2119, which would require all new vehicles in Washington be elective by 2030.

"It’s the most aggressive approach in the entire United States, five years ahead of California," said spokeswoman Dana Bieber. "I think that's something Washingtonians need to be aware of because this is going to be a costly burden for many families."