PORTLAND, Ore. — In October, the Oregon Department of Transportation began getting the word out that it will not have enough funding to plow or sand roadways over the coming winter to the extent that it has in previous years, blaming a combination of inflation and declining fuel tax revenue. But there is a distinction between the agency's messaging and the facts.

Pointing the finger at fuel taxes makes an intuitive kind of sense. More people are driving hybrids and electric vehicles every year, internal combustion engines have also been getting steadily more economical, and interestingly, ODOT's economists report that fewer vehicles are owned in Oregon now than before the pandemic.

But the idea that fuel tax revenues have declined is not factually accurate. The Story looked at the numbers behind ODOT's budget and could not verify that claim.

The Story's Pat Dooris reached out to ODOT Director Kris Strickler to request an interview, but was told he was not available. Regardless, the agency's messaging has been pretty clear.

"Like many transportation agencies around the country, we are seeing revenues go down as cars get more fuel efficient — and a large portion of our budget is the gas tax," said Katherine Benenati, ODOT assistant director of communications, during a recent news event on winter driving. "And inflation is really eating up more of our buying power. So, materials, labor, supplies, they're all costing more. And that is giving us some challenges when it comes to our budget. And you will see us out there less this winter and doing less maintenance around the state in general."

As a result of that falling revenue, ODOT said that impacts will be felt around the state. Crews will not be able to do as much roadside maintenance, for example, including cleanup of graffiti along Portland-area highways. The agency said in an announcement that it's had to cut the graffiti removal budget significantly, alongside things like grass mowing and litter pickup.

But the biggest issue, from a safety perspective, has to be the cutbacks to sand and de-icer application on highways in the Portland area. ODOT said it will have fewer seasonal employees, but will still prioritize the major thoroughfares: I-5, I-205, I-84, I-405 and Oregon 217.

The agency is warning Portland-area travelers to prepare for the possibility of extended delays and varying degrees of traction, along with extended closures and chain restrictions for areas outside of the Portland metro.

By the numbers

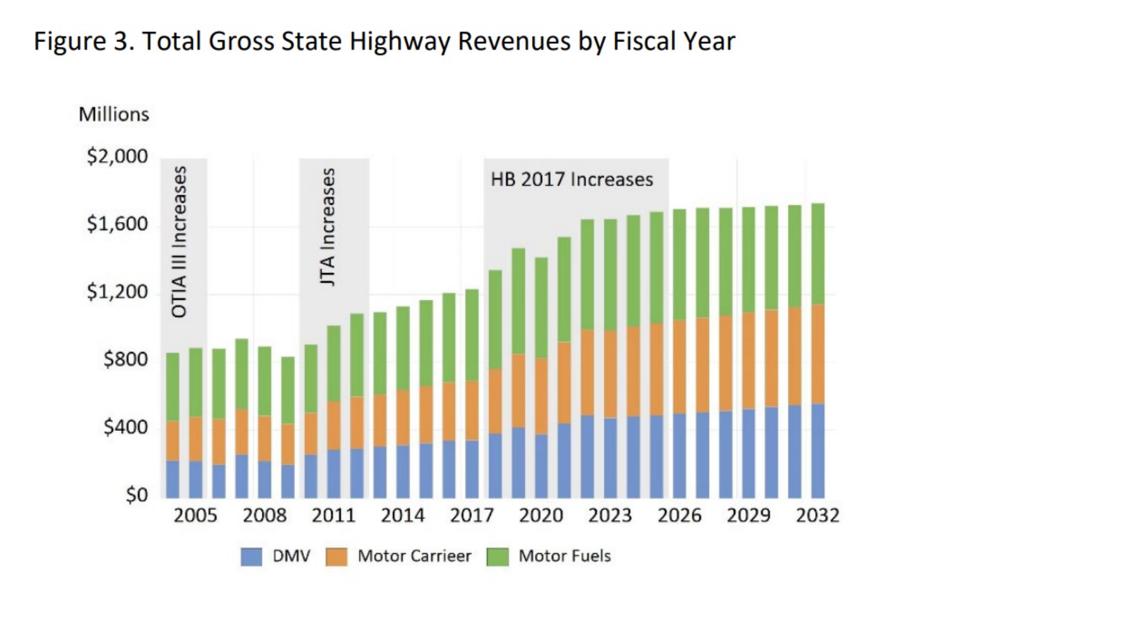

The October 2023 revenue forecast from ODOT includes a helpful bar chart showing the total amount of money coming in for this year. It's very close to what the agency received in 2022 — and the revenue from Oregon's gas and diesel taxes is likewise very close to last year.

In fiscal year 2023, those fuel tax revenues amounted to $669 million, which is about $17 million more than in 2022. An increase, then, not a decrease.

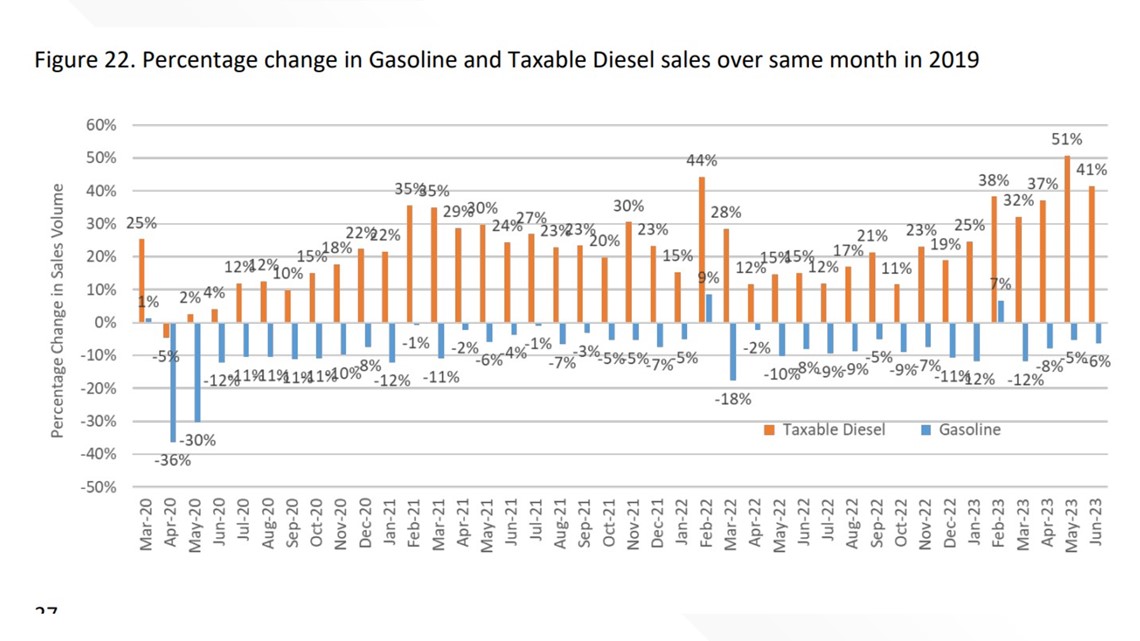

The report also contains a more granular look at fuel sales compared to the same month in 2019. Diesel sales are mostly up, while gas sales are mostly down. Much of that change can be attributed to people staying home during the COVID-19 pandemic while deliveries made on diesel trucks ramped up.

Looking at just the most recent data, spring 2023 gas sales were mostly down compared to 2019. But the fuel tax is derived from sales of both gas and diesel — and together they were up.

So it's not accurate to say that fuel tax revenues have gone down — they are still going up, although perhaps ODOT could argue that the pace of increase year over year has slowed while inflation grew dramatically over the pandemic.

Inflation rates in the U.S. peaked at 9.1% in June of 2022, but have since dropped considerably. After a slight climb over the summer, the rate plateaued at 3.7% in August and September. But that doesn't mean that prices for goods and services have gone down, only that price increases are smaller than they were a year ago.

It's also quite likely that Oregon's fuel tax revenues will truly start to decline eventually as the forces of electrification keep plugging along. But that's unlikely to happen in the near future: A fuel tax increase of 2 cents per gallon is expected to get tacked on in January.

When asked about this, an ODOT spokesman said that it's a matter of perspective:

"I think part of the issue may be that we think in terms of budget cycles and we try to manage to a fairly long timeline," he said. "It's true that revenue from the fuels tax is still growing for the very near future as the gas tax increases by $.02 in 2024."

The spokesman stressed that flattening revenue from the fuel tax is the primary driver behind the reduction in service levels.

Behind the budget

If ODOT knew that its source of revenue for operations and maintenance was in trouble, why not plan for that by setting aside funds for things like snow plowing and graffiti removal? To get insight from a budget expert, The Story's Pat Dooris turned to Oregon Sen. Elizabeth Steiner, co-chair of the state legislature's powerful Ways and Means committee. She's one of the key figures in charge of Oregon's purse strings.

"Well, they do budget for (plowing and road maintenance)," Steiner said. "But it depends entirely on gas tax revenues, because snow plowing and all other road maintenance comes from the Highway Trust Fund. The Highway Trust Fund is paid for with our gas taxes. If gas tax revenue goes down, Highway Trust Fund revenues go down, and that makes it hard to pay for things like snow plowing."

Dooris asked Steiner if ODOT couldn't build an emergency fund in anticipation of shortfalls, knowing that fuel tax revenues are going to continue to suffer.

"In theory, yes they could. We have not done that before and I don't think anybody anticipated that it was going to go down quite as much as it did," Steiner said. "It's certainly possible, and we are certainly going to we need to rethink how we pay for road maintenance in this state, because gas tax revenues will only continue to decline as fuel efficiency goes up, more people switch to hybrid or electric vehicles — and even on standard gasoline powered vehicles, fuel efficiency is going up. So we need to switch to an alternate method of funding for this."

Replacing fuel taxes with an alternative is not a new concept, and Oregon has been looking into it since at least 2001. In fact, it has quietly been running a "pay-per-mile" pilot program called OReGO for years now, but the legislation needed to make it more widespread hasn't yet made it across the finish line. The Story talked about the concept back in January.

"That's probably the most rational (alternative) because, you know, it's how many miles people drive that puts damage to our roads, so it makes sense for us to do that," Steiner said. "There have been some concerns in the past about privacy or whatever, but I think there are a lot of strategies around that and ways to deal with it. And frankly, unless you never allow your phone to have location services turned on your data, your location is being collected by private companies all the time."

Importantly, Dooris spoke to Steiner before going over ODOT's revenue report, so they didn't discuss the distinction between the "flattening" of fuel tax revenue versus a true decline.

The Oregon Legislature's emergency board meets this week in Salem, which could provide an opportunity for ODOT to request one-time funding to blunt the impact of service reductions, should they be so inclined.