OLYMPIA, Wash. — The Washington State Supreme Court ruled Friday that a capital gains tax is constitutional, reversing a lower court’s ruling.

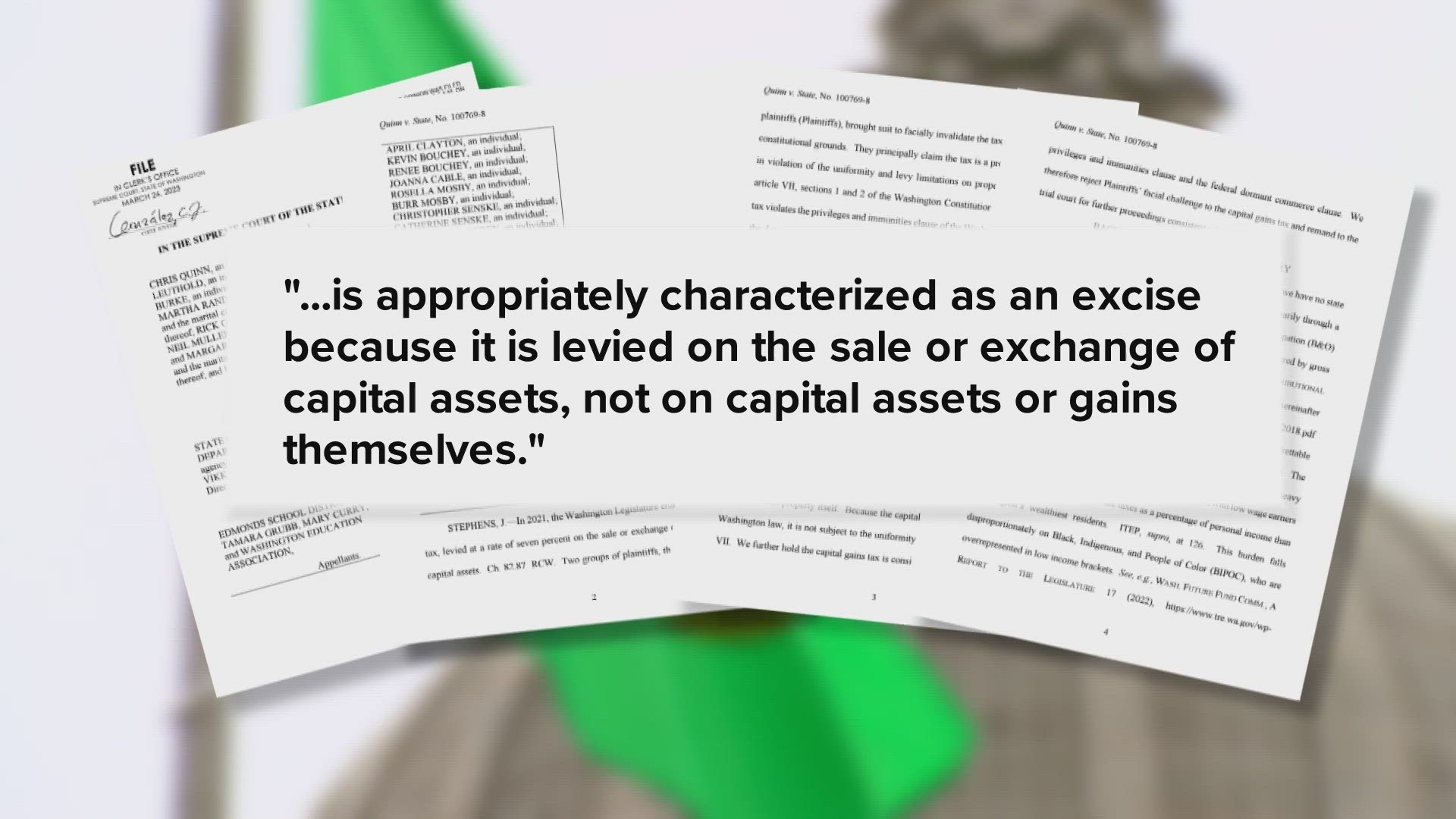

In the court’s majority opinion, Justice Debra L. Stephens wrote that the capital gains tax is appropriately characterized as an excise tax because it is levied on the sale or exchange of capital assets and not the assets or gains themselves.

“This understanding of the tax is consistent with a long line of precedent recognizing excise taxes as those levied on the exercise of rights associated with property ownership, such as the power to sell or exchange property, in contrast to property taxes levied on property itself,” Stephens wrote.

Two justices on the nine-member State Supreme Court dissented – Sheryl Gordon McCloud and Charles W. Johnson.

"There's nothing better in a state then when you can bring more fairness amongst our members of our blessed community, and that's what happened here today," said Gov. Jay Inslee.

Republican Sen. Lynda Wilson said the ruling surprised her.

"Every other state in the union and the IRS still calls it (capital gains) an income tax," said Wilson.

She said while the Constitution still prevents legislators from enacting an income tax, she expects Democrats to lower the threshold for the capital gains tax and perhaps pursue other taxes.

"I do believe the people should be on guard," said Wilson. "We should be vigilant in watching what's going on."

The tax on the state's top investment earners passed in 2021. It was expected to raise hundreds of millions for education in a state that supporters of the tax say relies too heavily on sales tax.

However, critics argued the capital gains tax is a form of income tax – prohibited by Washington state's Constitution.

In March of 2022, Douglas County Superior Court Judge Brian Huber agreed with opponents, ruling it was an unconstitutional tax on income.

Huber cited several elements of the law that he said “show the hallmarks of an income tax rather than an excise tax," including reliance on federal IRS tax returns that must be filed by Washington residents, the fact it is levied annually instead of at the time of the transaction, and that it is based on an aggregate calculation of capital gains over the course of a year.

State Attorney General Bob Ferguson said his office would appeal the ruling, sending the decision to the state Supreme Court.

“There’s a great deal at stake in this case, including funding for early learning, child care programs and school construction," he wrote at the time. “Consequently, we will continue defending this law enacted by the peoples’ representatives in the Legislature.”

The measure passed in 2021 imposed a 7% tax on the sale of stocks, bonds and other high-end assets in excess of $250,000 for both individuals and couples.

The tax took effect Jan. 1, 2022. First payments are due on or before April 18.

Under the State Supreme Court's ruling, Washington can continue collecting taxes on the state's top investment earners.

It was projected to bring in $415 million in 2023, the first year the state would see money from the tax.

Supporters of the tax say that Washington — one of a handful of states with no income tax on wages — leans too heavily on its sales tax, disproportionately affecting those with less income. When the governor signed the new tax into law last May, Washington joined 41 states plus the District of Columbia in having a capital gains tax.

Retirement accounts, real estate, farms and forestry were all exempt from the tax. Business owners were also exempt from the tax if they are regularly involved in running the business for five of the previous 10 years before they sell, own it for at least five years, and gross $10 million or less a year before the sale.

Under the new law, taxpayers could deduct up to $100,000 a year from their capital gains if they made more than $250,000 in charitable donations in the same tax year, something Huber cited in his ruling, noting that like “an income tax and unlike an excise tax, the new tax statute includes a deduction for certain charitable donations the taxpayer has made during the tax year.”