Is marijuana tax revenue going where voters intended?

According to the audit, there hasn’t been any public reporting on about 94% of the total cannabis tax allocations, which is about $7.7 million.

From growing in his garage to growing his own business, Jesce Horton knows first-hand the struggle of being an African American man trying to make it in the ever-growing legal cannabis landscape.

“Access to capital is the biggest hurdle for people of color in the industry,” Horton said.

A self-described “cannabis connoisseur,” Horton recently started LOWD, a newly-licensed recreational cannabis cultivation facility in Portland. The operation is currently undertaking its first harvest.

A successful engineer in Florida prior to diving into the weed world in Oregon, Horton grows craft cannabis with help from family and friends.

“I don't think I've had the same amount of success on the other end when it comes to fundraising, when it comes to getting financial support in order to continue to grow,” Horton said.

Horton also knows first-hand how the prior criminalization of cannabis hit minority communities especially hard. He says after his dad was accepted to college he was caught with an ounce of cannabis. Instead of spending four years in college, his father spent seven years in prison.

Horton was arrested a few times for having pot on him, too.

“It really had a big effect on my future at the time, my self-esteem.”

He feels it’s time more people of color have seats at the table; not just because it’s the right thing, but because there is an opportunity to grow the industry the right way.

“We've really done a lot of people a disservice and in general cannabis prohibition has done the whole country a disservice. So if we have the opportunity to make things right I think we have to do it,” Horton added.

Portland voters seem to agree that the city needs to make things right.

Portland’s recreational cannabis tax

In November 2016, voters approved Ballot Measure 26-180 allowing the city to collect a 3% local tax on recreational cannabis sales.

The measure didn’t lay out exactly how much each category would get and the language was intentionally broad to meet the changing needs and future priorities.

The Portland City Council also established expectations that the public would be involved in tax allocation decisions and links between the source and used of the tax revenue and spending decisions would be clear to the public.

The measure requires a yearly city council vote on how the money is allocated and it requires annual reporting to the public, along with periodic audits.

But the measure said the tax revenue should be used in the following three areas:

- Drug and alcohol education and treatment programs, including services that help with access to drug and alcohol education and treatment, and rehabilitation and employment readiness programs.

- Public safety -- including police, fire, and transportation -- to protect the community from unsafe drivers. Examples include Portland Police Bureau DUII training and enforcement, street infrastructure projects to improve safety and initiatives to reduce impacts of drug and alcohol abuse.

- Support for minority and women-owned businesses, and providing economic opportunities and education to communities disproportionately impacted by prohibition of cannabis. Priorities are record-clearing, workforce development and industry support and technical assistance.

Horton’s wife Jeanette wrote the ballot measure that dictated how the cannabis tax revenue should be spent.

“This particular initiative is very close to my heart,” she said. “The legal cannabis world is a boon of cannabis taxes and there are communities that really need that money in order to grow and contribute to your city and state economies.”

Jeanette also runs a nonprofit called NuLeaf Project, which was created after the tax passed and was empowered by Prosper Portland through the city to award money earmarked for racial and social justice efforts.

Their mission is to address multi-generation economic harm the War on Drugs had on minority communities, particularly African American communities, through reinvesting cannabis taxes into those communities. Jeanette said NuLeaf accomplishes that by supporting minority-owned cannabis businesses through education, mentoring and direct grants.

"The harm done to communities of color, specifically African American communities with over-policing, over-targeting of cannabis arrests has been documented to be economic harm that lasts for generations," Jeanette said, "An arrest and incarceration impacts your ability to get loans for school, impacts your ability to get loans for businesses, impacts your ability to get housing, it stifles your job opportunities."

With the tax revenue, NuLeaf has awarded four grants to minority-owned cannabis businesses so far; there were two big grants and two small grants that went to licensed businesses trying to grow. But those “big” grants were each capped at $30,000.

“Capital has made a big difference for these businesses’ ability to succeed,” Jeanette said. “People of color have less access to capital versus what white people have access to, and that really is the game changer.”

Audit: “Greater transparency and accountability needed”

The Portland city auditor released an audit on the recreational cannabis tax in May 2019.

It said for the first two years of the program, "The use of the tax may not meet voters’ intent."

Allocation decisions aren’t transparent or accountable to the public, according to auditors, and the money is being used in part to backfill budget shortfalls in the general fund.

The audit found 79% of the tax went to police and transportation, while 5% went to drug and alcohol programs and 16% percent went to small businesses and probation effects.

In the 2018-19 fiscal year, Portland Police Bureau’s DUII training and Vision Zero traffic enforcements received the largest chunk of the cannabis tax revenue, while the bureau of transportation (PBOT) received the second-largest piece for Vision Zero projects and infrastructure.

Auditors said in the summary, “Community members, cannabis businesses, or others affected by past cannabis policies have not been involved in the overall budget decisions, and the city has not reported on how it’s used the tax revenues.”

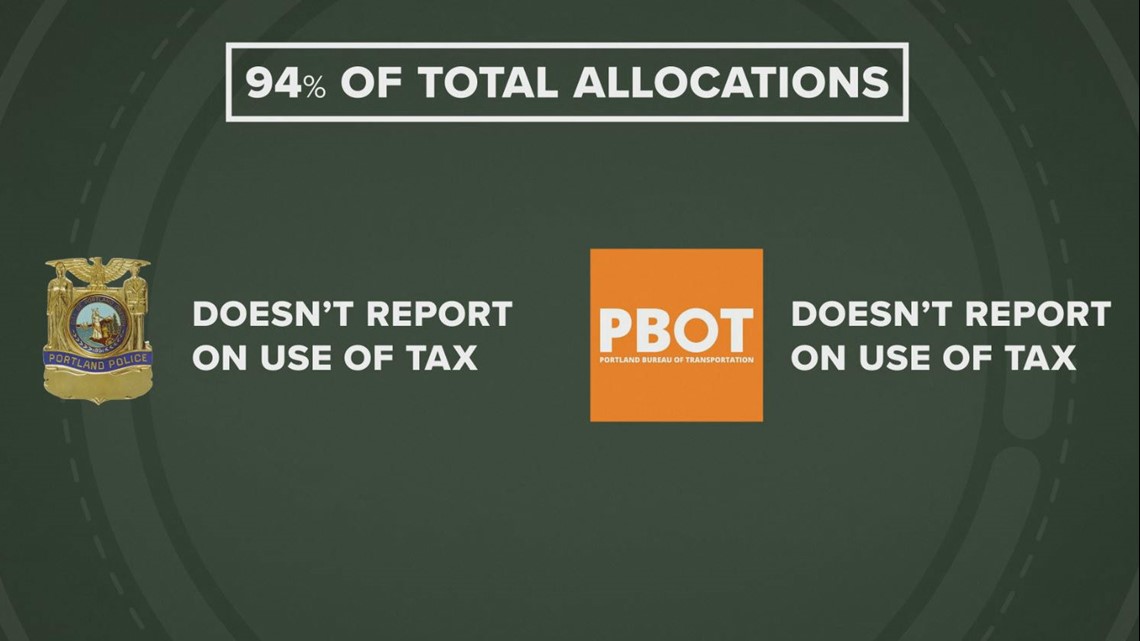

According to the audit, there hasn’t been any public reporting on about 94% of the total tax allocations, which is about $7.7 million.

The audit found police and transportation bureaus have not reported on the use of the tax and how it relates to cannabis legalization, despite the ballot measure’s requirement for annual reporting.

“Voters saw the money was going to go to public safety, drug and rehabilitation programs, and it was going to go to investments in these communities harmed by the War on Drugs. And you see that laid out and you think one-third, one-third, one-third – at least. And that's not what we saw the audit reveal,” Jeanette added.

Lack of money for drug and alcohol treatment

As the audit mentioned, there is a larger disparity in funding for drug and alcohol treatment and education programs. The audit showed a police bureau program didn’t receive ongoing funding in the second fiscal year.

In the 2017-18 fiscal year, under the drug and alcohol treatment category, the tax helped fund Portland Police Bureau’s Service Coordination Team, which assists repeat drug and alcohol offenders in accessing treatment and housing services.

General funds to the program were cut, so the city council used $410,000 in recreational cannabis tax money to pay for the services that year. But in 2018-19, the team was funded through the general fund, and no additional cannabis tax revenue allocated to drug and alcohol education or treatment services.

The audit says the lack of yearly and consistent cannabis tax funding for drug and alcohol treatment – along with small portion of money addressing negative effects of historical cannabis prohibition – “May not be consistent with expectations by tax proponents focusing on the value of the tax for expanding addiction programs or to benefit those that were disadvantaged during prohibition."

Social Equity Grants

In the 2017-2018 fiscal year, just $500,000 went toward the Social Equity Grant portion to benefit women-owned and minority-owned businesses and those disproportionately impacted by cannabis prohibition.

Grants the first year were split up to pay for:

- Development of minority-owned cannabis businesses through NuLeaf support;

- Workforce development and re-entry done by Green Hop LLC and Portland Opportunities Industrialization Center + Rosemary Anderson High School

- Criminal records expungement through Metropolitan Public Defenders

That was out of a total of $3.6 million dollars in tax revenue that year.

The next year, that revenue jumped slightly to $700,000 out of $4.6 million total.

The Office of Community & Civic Life manages that $700,000 and proposed similar priorities for the Fiscal Year 2018-2019, with one other priority: record-clearing, workforce development, industry support and technical assistance, as well as re-entry housing services.

According to a March report Civic Life published, 30% of the social equity grants ($210,000) are dedicated to supporting minority-owned cannabis businesses (through Prosper Portland), while the remaining $490,000 will be awarded through a competitive grant process to organizations focused on record-clearing, workforce development and re-entry housing services.

Brandon Goldner helps oversee the City of Portland’s Cannabis Program and now the social equity grants in the Office of Community & Civic Life.

“Our bureau and commissioner-in-charge agree with the findings of audit: there does need to be more transparency in the way in which the city allocates that tax money,” Goldner told KGW.

It is a tough balancing act for city council, Goldner says, since public safety and transportation infrastructure are also critical.

When asked if it is the bureau’s view that it’s important more money be funneled toward investments in minority-owned businesses, Goldner responded:

“We believe so. But again, that’s a question for Council. But we do think there’s a huge opportunity for government that in the past has perpetuated wrongs, particularly against communities of color in cannabis prohibition – we have a responsibility to undo those harms.”

The audit also said the process for understanding and applying for social equity grants with Civic Life is murky.

The future of the cannabis tax

Goldner’s office pitched solutions to issues laid out in the audit to the commissioners a couple of months ago, and Goldner says commissioners are mulling them over.

One option they pitched is creating a commission filled with experts in each of the three areas to report on how the money is being used. Another option is making the tax allowances less broad by defining a percentage for each of the uses.

Goldner says the city’s public advisory body on cannabis policy, Cannabis Policy Oversight Team, will now facilitate discussions over priorities for the social equity grants with the community. Civic Life also created a website to provide information, context and updates about the city’s cannabis tax allocation processes and results.

“It’s not perfect. We’re not done. The work continues and these are steps we can make in the right direction,” said Goldner.

The Hortons are optimistic things will change. With the audit kicking the city in the right direction, they say they’re hopeful voters will have more of a say in the allocation process.

“We’re at a start. We’ve started. And a start is better than a lot of places,” Jeanette said.

They’re also hopeful more businesses like Jesce Horton’s will have the opportunity to thrive.

“If the full voice of the voters was really shown in how the taxes are implemented, I mean, imagine how we could create a better industry in Portland,” he said.

KGW reached out to the Portland city commissioners and Mayor Ted Wheeler to understand how they voted to allocate the tax during the budgeting process over the last few cycles.

The Mayor's Office on Tuesday responded with the following statement:

The ballot measure voters approved for a cannabis tax in the City of Portland does not include language specific to the proportionality of the tax allocation. The funds are allocated at the discretion of the commissioners through the regular budget process, and the allocation is subject to change each year. Also, programs and services such as drug and alcohol education and treatment programs can—and do—receive funding through other avenues in the budget.