PORTLAND, Ore. — Sen. Ron Wyden is demanding tougher security for the benefit cards that low-income families use to buy groceries. Earlier this month, Wyden sent a letter to Agriculture Secretary Tom Vilsack urging the USDA to upgrade government issued Electronic Benefit Transfer (EBT) cards with smart chip technology, which make them more difficult for fraudsters to skim.

“What I want to do is put the thieves out of business,” Wyden said. “You’ve got criminals using a security weakness in these benefit cards to literally steal food from Oregon families in need.”

A two-part KGW investigation documented how fraudsters are wiping out food stamps and cash assistance benefits from low-income Oregonians. One Portland mother had $820 in benefits stolen over a two-month span. Another woman lost nearly $500 in Supplemental Nutrition Assistance Program or SNAP benefits.

“We rely on those benefits to eat,” Lisa Jones told KGW in February. “That’s a huge impact to our family.”

Over the past several months, the USDA along with several states have warned about fraud tied to EBT accounts due to card skimming.

Missing security feature

Crooks often skim EBT cards by secretly installing a device on ATM readers that sends card numbers and pin numbers back to the thieves — who then create fake cards and drain accounts.

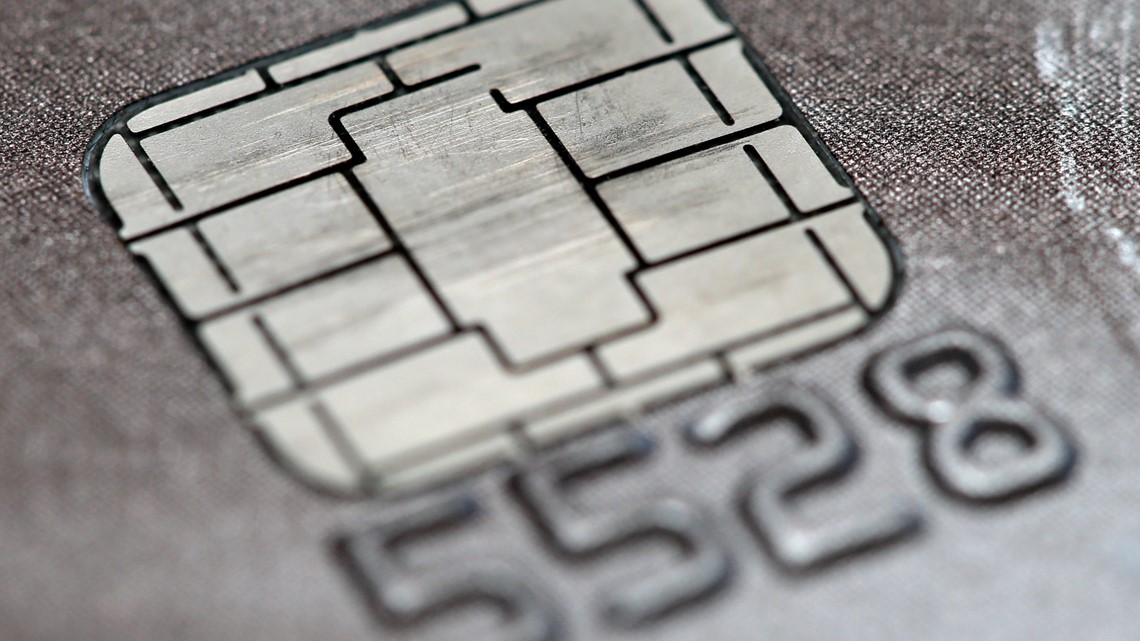

EBT cards are especially vulnerable because they don’t have a smart chip like most modern credit cards or bank debit cards.

In his March 16 letter to the USDA, Wyden warned the old-fashioned magnetic stripe cards, dating back to the 1960s, are easy for criminals to clone. As a result, some companies such as Mastercard have already announced plans to phase out magnetic stripes in the next few years.

Wyden urged the USDA to update its security requirements by pushing states to start using smart chip technology and stop issuing EBT cards with a magnetic stripe.

“I want to play some really aggressive catch-up ball and make sure that we have a strong federal standard, not wait around anymore, not see any more people get hurt, not see more tax dollars lost by using this outdated technology,” Wyden said in an interview with KGW.

Skimming can be devastating to households already struggling to make ends meet, especially because some states — including Oregon so far — have declined to reimburse victims.

In December, Congress approved a law that allows food stamp or SNAP recipients to be reimbursed for stolen benefits. The law requires states to replace benefits that were stolen between Oct. 1, 2022, and Sept. 30, 2024. But first, all 50 states must submit a plan on how they’re going to do that.

Oregon’s proposed plan, obtained through a public records request, shows DHS intends to replace food benefits stolen by card skimming through a process similar to how it handles benefits lost to a fire, flood or power outage.

Fraud victims would provide a signed affidavit explaining the date of the loss, how much was taken and other details. DHS staff would then view activity on an EBT card to verify if the amount and timeline was correct. USDA must approve the plan before Oregon can begin replacing benefits.

Oregon DHS also intends to beef up fraud detection by monitoring and reporting benefits stolen by card skimming or cloning.

“Additional measures that increase overall card security are also being evaluated, such as adding chip technology to the card,” Oregon DHS wrote in its proposed plan.

The chip is the key part — fraud victims have emphasized the importance of the chip throughout KGW's reporting. Tricia Collins of Portland argued EBT recipients should have the same security technology as everyone else using the banking system.

“I’m sure they have enough money to put a chip in a damn card,” said Collins in January, after fraudsters had wiped out her benefits.

A spokesperson for the USDA explained the federal agency is exploring chip card technology, along with other security measures to avoid skimming fraud.

“Any state agency can choose to adopt chip enabled cards. SNAP state agencies do not need a waiver or approval,” said the USDA spokesperson.

Currently, every state — including Oregon — is still using the old-fashioned cards with a magnetic stripe and no chip, leaving low-income households vulnerable to fraud.

“It is urgent business,” Wyden explained. “You know, people are suffering.”