PORTLAND, Ore. — Bought a plane ticket lately? If so, you probably got an offer to buy trip insurance. Airlines are pushing travelers to spend a little more to protect against delays and cancellations. The hard sell includes pitches like “protect yourself” and “guard your trip against the unexpected.”

So, is it worth it? We tried to answer that question and others by speaking with travel experts, consumer advocates and industry insiders.

Should I buy travel insurance?

In most cases, consumer advocates say the trip protection policies pushed by the airlines aren’t worth it--they’re a bad buy.

“We dug into these policies and found most of them don’t have a lot of value,” said Kevin Brasler, executive editor of Consumers’ Checkbook. The nonprofit consumer organization found most trip protection plans offered by the airlines have little coverage and a long list of exclusions.

On the other hand, travel experts suggest some international travelers might want to consider shopping around for trip insurance to protect against risks that could be financially catastrophic- like a dream vacation that cost thousands of dollars and is non-refundable.

What does trip insurance cover?

The airlines claim to “protect” customers against their own expensive cancellation fees and non-refundable charges, but critics argue travelers who purchase these policies through airlines may get much less coverage than they are led to believe.

A 2018 report by Sen. Edward Markey (D-Mass.) found these policies “are often riddled with exclusions and limitations that can render them useless.”

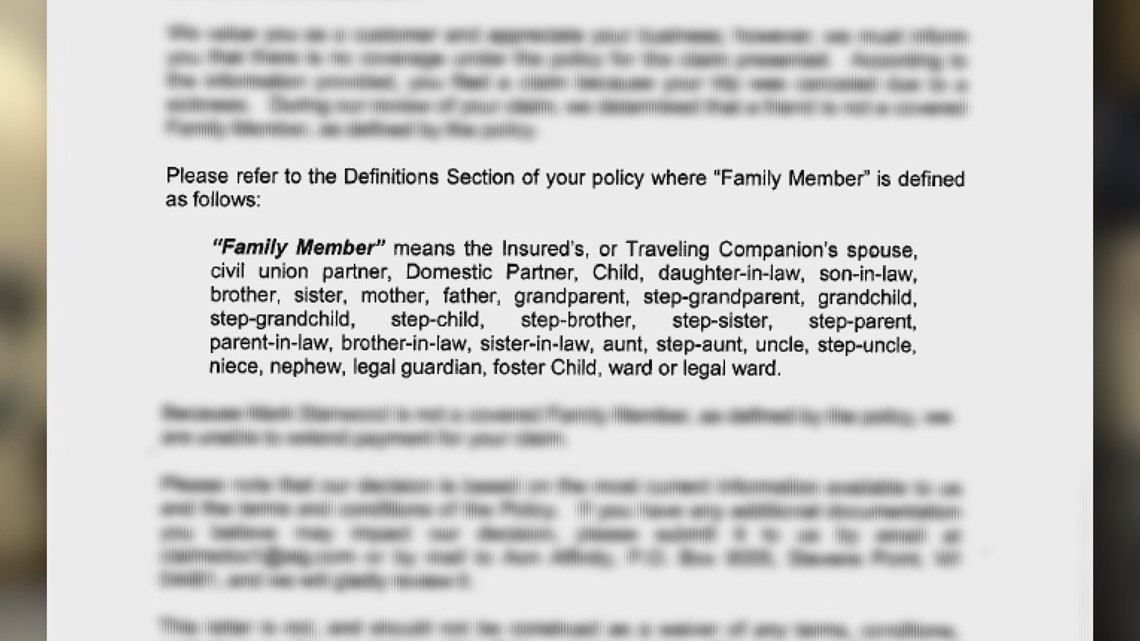

It’s important to read the fine print, where you’ll find a long list of limitations and exclusions. For example, Cal Calhoun of Warren, Oregon, bought a $21 cancellation plan offered by Expedia to help protect his $300 plane ticket to California. Unfortunately, Calhoun had to cancel the trip because his friend got sick. The insurance company wouldn’t refund his plane ticket because the policy only covered cancellation due to a sick family member-- not friends.

“To me, it’s not a policy. It’s a loophole,” said Calhoun. “It’s just not right.

Policies usually cost $15-$30 per person for inexpensive flights and up to 15% of the airfare for more expensive flights or vacation packages.

Do all airlines offer travel insurance?

Almost all airlines require customers who buy a ticket to either purchase or decline to purchase travel insurance. There is at least one exception: Southwest Airlines. Southwest doesn’t charge customers additional fees for changing travel plans.

Airlines and booking sites get a cut of each insurance purchase and get paid to promote insurance providers on their websites.

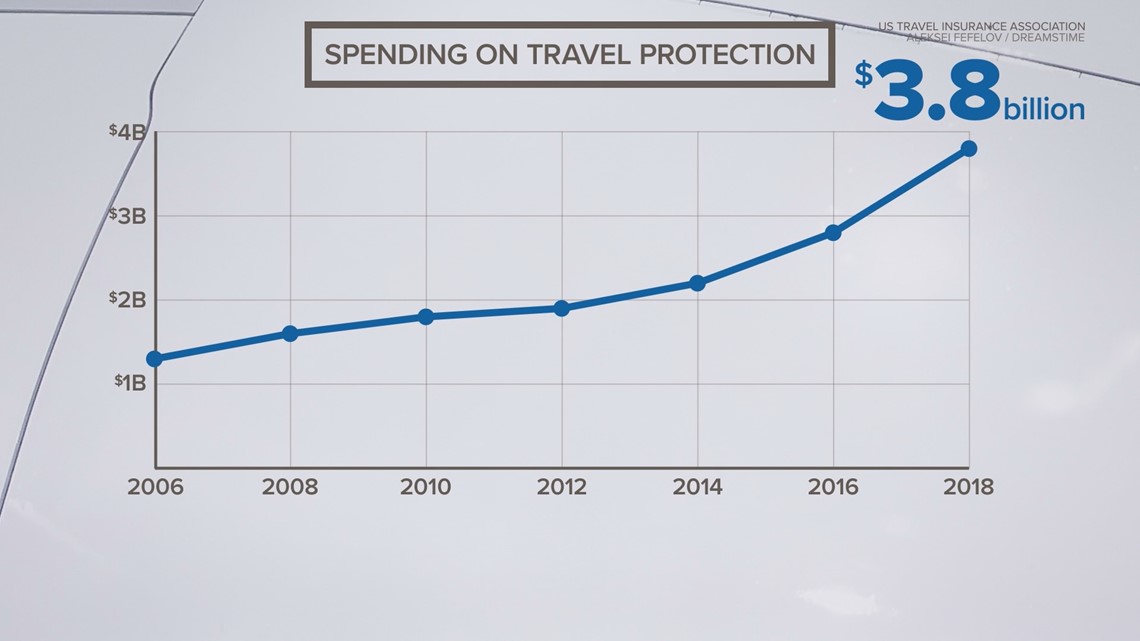

“Everything is about making money,” said airline industry expert Richard Gritta from the University of Portland. In 2018, Americans spent $3.8 billion on travel protection, an increase of 41% from 2016, according to the U.S. Travel Insurance Association.

If I decide to buy travel insurance, any suggestions?

Shop around for the best plan by comparing insurance policies and prices. Websites such as QuoteWright.com, Insuremytrip.com, and SquareMouth.com allow you to customize your policy for features you do or don’t want. Again, travel experts say don’t buy the travel insurance offered by the airlines and read the fine print.

Besides refunding an expensive plane ticket, any other reason to consider travel insurance?

If you are traveling overseas, you might want to consider international travel medical insurance to cover your healthcare expenses. If you get hurt or sick, some health insurance plans won’t cover you on international trips. Medicare, for example, won’t help with medical expenses overseas.

If I don’t have travel insurance, is there anything I can do?

Check with your credit card company. Some credit cards offer coverage for trip cancellation, car rental damage or lost luggage as a free perk for customers. Also, try asking for help. Hotels, cruise lines and tour operators are in the hospitality business. They want customers to return and post positive online reviews. If you ask, they might be willing to help change plans or provide some level of accommodation.