PORTLAND, Oregon — Local government is finally responding after a flurry of calls, emails and complaints about demand letters claiming people owe money for new taxes meant to fund homeless services and preschool — even though they already paid.

In a joint statement released Friday, Metro, Multnomah County and the city of Portland explained they are working to answer taxpayer questions and provide clarity to a complex tax collection system.

“Confusion about the recent notices shows we have room to improve, and we are committed to doing so,” the statement read.

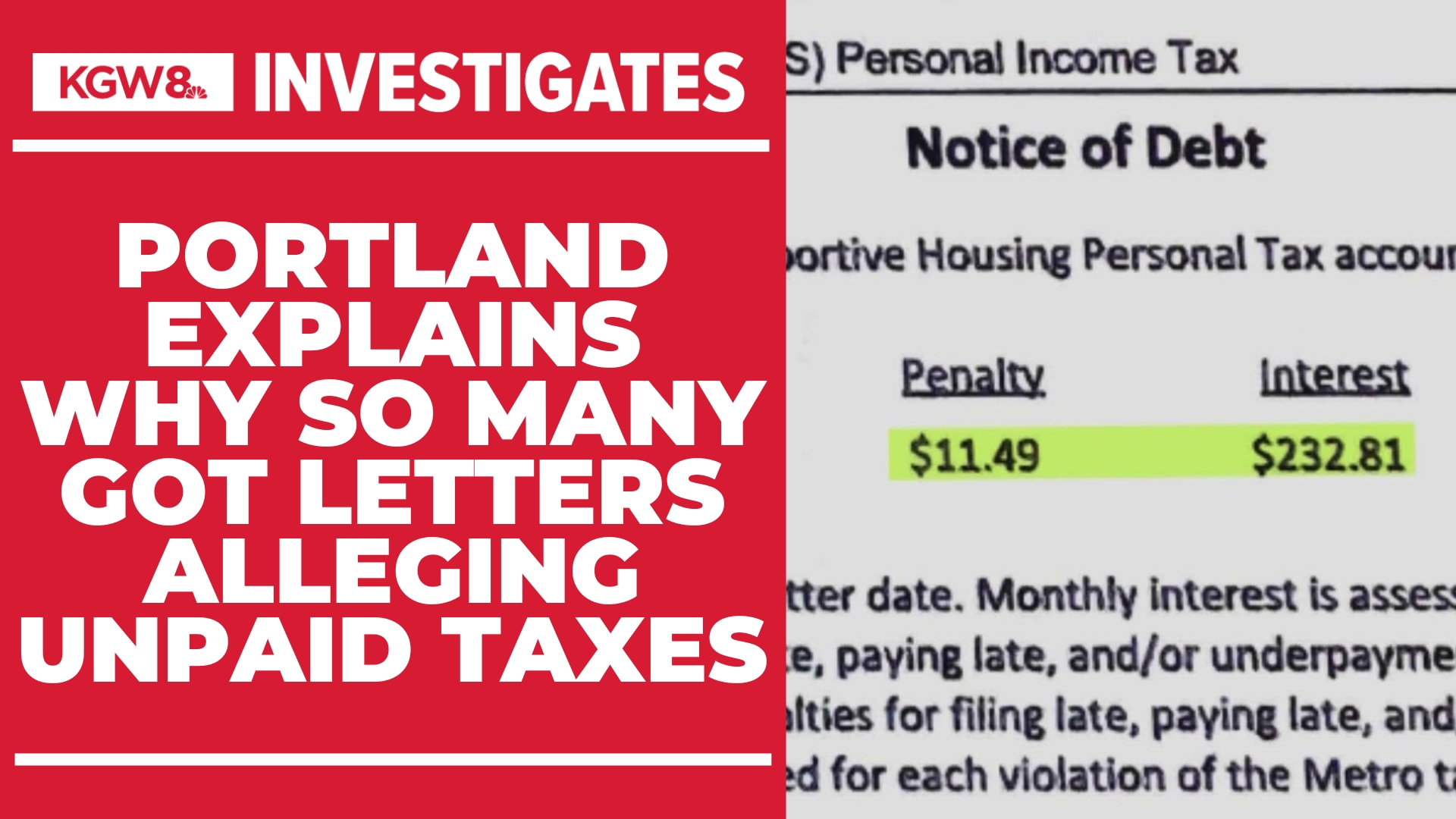

The joint statement came roughly one week after the city of Portland mailed out nearly 12,000 letters to high-earning taxpayers about Metro’s Supportive Housing Services tax and Multnomah County’s Preschool for All tax. The Notice of Debt letters created all kinds of confusion because they didn’t explain the problem and left many people waiting on hold for hours seeking answers from the city.

“The first time I called there were 128 people waiting ahead of me in the queue,” said Marc Steinmetz. The taxpayer was baffled after receiving the letter claiming he owed penalties and interest on Metro’s homeless services tax — even though he’d paid it in full.

PREVIOUS REPORTING: They paid their preschool and homeless services taxes. Then the city told them they hadn't

After reviewing his bill, the city said it would waive the penalty, but not the interest — leaving Steinmetz even more perplexed. He’s requested the city waive the interest too.

“It is frustrating,” said Steinmetz.

The city of Portland collects the taxes on behalf of Multnomah County and Metro.

“We expect the customer service from the Revenue Office to be held to the highest standard. We’ll be working with our partner to improve the way this works in the future,” wrote Nick Christensen, spokesperson for Metro.

The voter-approved personal income taxes only apply to individuals who made more than $125,000 annually or couples who bring in more than $200,000 dollars combined. Metro collects 1% tax on income over those thresholds for the homeless services tax. Multnomah County asses a tax of 1.5% over that threshold. The tax rate bumps up to 3% for all income above $400,000.

The city requires that taxpayers who would owe more than $1,000 in a tax year make quarterly estimated payments, but some people didn’t or underpaid, resulting in letters demanding penalty and interest.

“Many of these taxpayers may be unfamiliar with quarterly estimated payments and may not have experienced underpayment fees before,” the governments’ statement explained.

Steinmetz argued that it would be a whole lot easier if people just paid once a year.

The money being collected is piling up. Metro’s Supportive Housing Tax was projected to bring in $250 million dollars a year. Instead, it has wildly exceeded expectations, bringing in $850 to $900 million in the first three years, according to the Metro spokesperson.

So, why so aggressive in collecting these new taxes and use such a complex collection system?

“We are currently working on a review of the SHS system to see if there are reforms that can improve the Supportive Housing Services program as it moves forward," explained Christensen.

The city warns taxpayers not to ignore a Notice of Debt letter they've received. Taxpayers who have questions should contact the City of Portland Revenue Division tax help line at 503-865-4748 or email SHS.Tax@portlandoregon.gov (for Metro) or PFA.Tax@portlandoregon.gov (for Multnomah County) for assistance.