PORTLAND, Ore. — Regina Fleming describes herself as frugal. The West Linn mother is extremely careful with her family’s finances.

“I drive a car with over 300,000 miles on it because I don’t want a car payment,” explained Fleming.

Which helps explain why Fleming was so surprised after learning she’d been sued over consumer debt. In November, a company called LVNV Funding LLC filed a lawsuit against Fleming in Clackamas County Circuit Court seeking roughly $2,100 in unpaid bills, along with interest and fees, dating back to 2018.

“For something to just randomly show up, it is a big red flag,” said Fleming. “I would know if this was my debt.”

Adding to the mystery — the information listed on the invoice attached to court papers was outdated, according to Fleming. The paperwork included a California address and last name that Fleming hadn’t used in years.

“I don’t know if it was a store credit card. I don’t know if it was one transaction, multiple transactions. To this day, no one has told me what the debt is,” said Fleming, who questions if she legitimately owes the debt she is being sued for.

Instead of just giving up, Fleming decided to fight back. Most people don’t. According to a 2022 Pew Charitable Trust report, more than 70% of debt collection lawsuits end in default judgments against defendants.

Fleming said no attorney would take her case because the dollar amount is too low. The fees would exceed the value of the debt. The Pew Charitable Trust report also found that less than 10% of consumers facing debt collection lawsuits have lawyers.

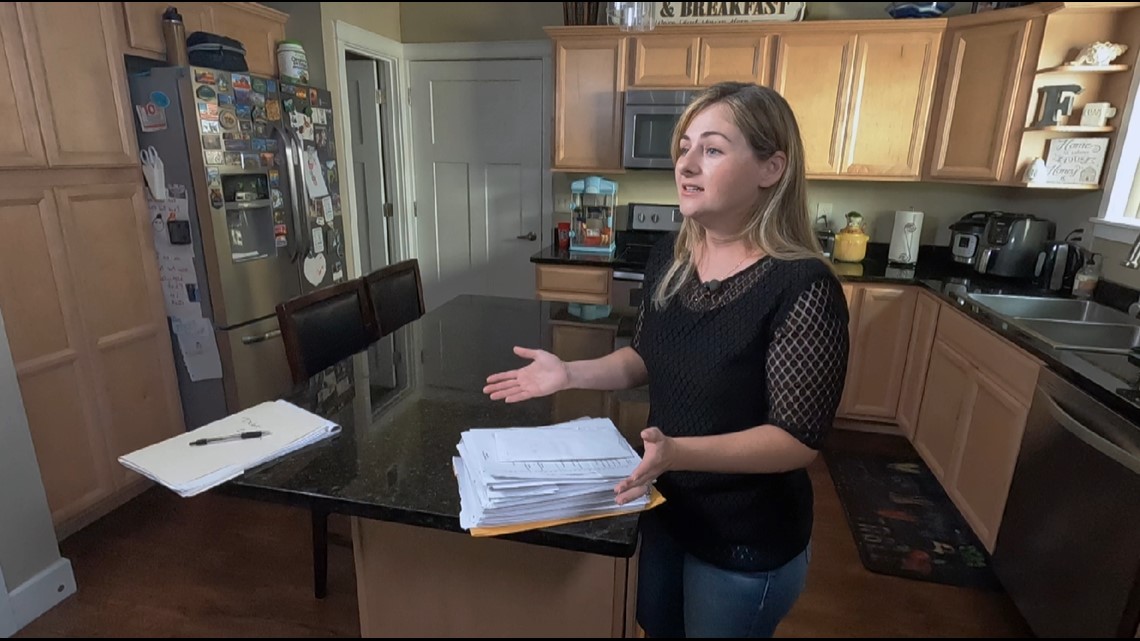

So, Fleming did her own research online. She spent more than 100 hours writing and printing documents at the public library. She also relied on ChatGPT, the artificial intelligence chatbot.

“I actually used ChatGPT a ton to help me through this,” said Fleming. “I would go in and say, ‘I’m looking for information on this’ or, ‘What is a way I would say this in a legal document?”

There are legal organizations that offer free representation to low-income people, but they tend to focus on things like evictions, foreclosures and help with domestic violence cases.

Facing off against professionally trained lawyers representing a debt collection company can be daunting, Fleming admits.

“They know that people are not going to be able to get attorneys. They know people are not going to be able to fight back,” said Fleming.

LVNV Funding, the company suing Fleming, claimed it bought the debt from Synchrony Bank, according to court documents. Consumer debt may be resold, changing hands several times. Fleming said she’s never done business with Synchrony Bank and wonders if this is a case of mistaken identity or even identity theft.

LVNV Funding declined to comment for this story.

Over the past decade, Oregonians have filed roughly 4,000 complaints with the federal Consumer Financial Protection Bureau over debt collection. Of those complaints, 43% involved creditors attempting to collect debt that wasn’t owed, according to federal data.

RELATED: ‘It is like robbery’: A debt collector wrongly wiped out an Oregon man’s entire bank account

Consumer advocates explain that it's hard for consumers to hold collectors accountable for debts they don’t owe.

“If they don’t owe the debt, so it’s not their debt — under current Oregon law, unfortunately, there is not a clear path,” said Chris Coughlin, policy director for the nonprofit Oregon Consumer Justice.

Coughlin suggests that the most important thing consumers can do is respond to a lawsuit. That means writing a response or showing up to court, regardless of whether you think you owe the debt or not.

“Don’t ignore it,” explained Coughlin. “You have 30 days to respond.”

When consumers fail to respond, they lose the case by default. Then, a debt collector may be able to garnish wages or take money from your bank account.

“Bullies target weak people that don’t fight back or can’t fight back for themselves,” explained Fleming.

Three years ago, New Mexico’s Attorney General filed a lawsuit against LVNV Funding as part of a nationwide crackdown led by the Federal Trade Commission, dubbed Operation Corrupt Collector. LVNV Funding sought to have the case dismissed. In May, a judge ruled in favor of LVNV Funding, granting summary judgment.

Meanwhile, the company continues going after consumers. A review of court records showed that last year, LVNV Funding filed more than 2,600 debt collection lawsuits against Oregon consumers, including Regina Fleming.

“It’s been hours and hours and so much anxiety,” explained Fleming.

With claims of unpaid debt and a lawsuit hanging over her head, Fleming has been forced to reassess. Her family had planned to move into a larger home, instead, they’ll stay in their apartment. Fleming admits that she could have figured out a way to pay — and the lawsuit would have gone away.

“I refuse to roll over and just give up,“ Fleming explained. “Until people start standing up and fighting against this stuff, it is going to continue keep happening again, over and over and over again.”

The Federal Trade Commission offered the following advice for consumers sued by a debt collector:

- Answer the lawsuit, which you may have to do in writing or by showing up to court — or both. The papers that say the debt collector is suing you will tell you what to do.

- Look over your records about the debt and any information you may have gotten from the collector, including the validation information that debt collectors must send you.

- Spot any issues with the lawsuit. It’s the collector’s responsibility to prove claims made in the lawsuit. They must prove that you’re the person who owes the debt, the debt amount is accurate, including any interest or fees, and you owe the debt to them and not to someone else. If the debt is old, make sure the time for the collector to sue hasn’t already expired.