PORTLAND, Ore. — The founder of a Portland nonprofit is facing federal charges in connection with alleged fraudulent applications for COVID-19 relief funds, according to court documents.

Theodore Johnson of Beaverton was charged with bank fraud after receiving $273,165 in Paycheck Protection Program funds for the Ten Penny International Housing Foundation.

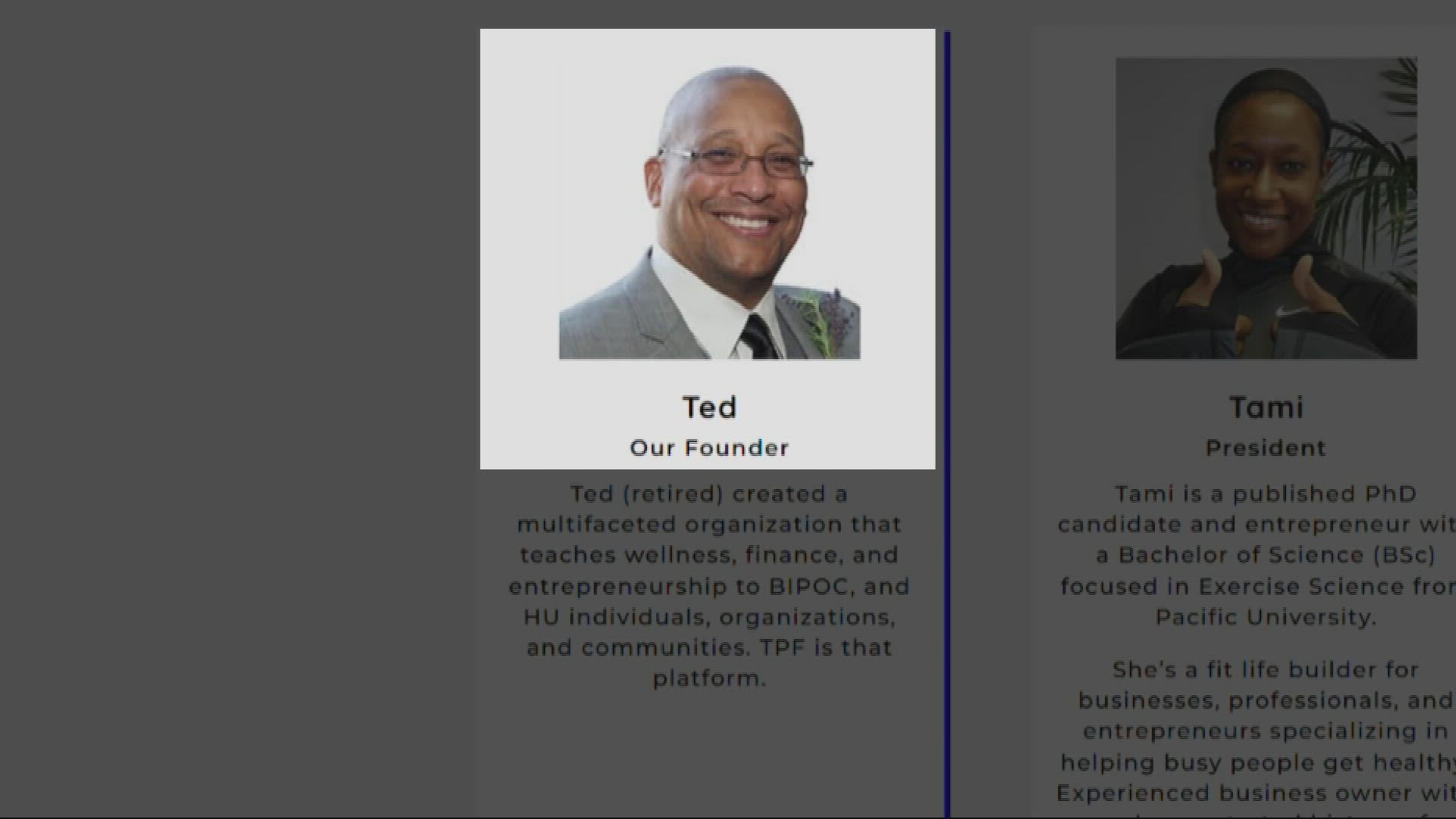

Johnson is the founder of Ten Penny and served as president, executive director, board chairman and CEO. The Portland nonprofit provides food, rental assistance, utility aid and services to BIPOC families and small businesses, according to its website.

Federal prosecutors claim Johnson submitted two fraudulent PPP loan applications to the Small Business Administration by inflating the number of employees and amount of payroll expenses the organization had.

In March 2021, Johnson applied for a PPP loan in the amount of $143,065. On the application, federal prosecutors allege Johnson falsely claimed Ten Penny employed 16 workers and the company’s average monthly payroll was roughly $57,000.

To help corroborate the claims, prosecutors said Johnson submitted bogus 2019 tax forms including using a counterfeit IRS stamp indicating the document had been submitted to the IRS.

The true 2019 IRS 990-EZ form reported Ten Penny had only six employees.

In May 2021, Johnson applied for a second PPP loan seeking $130,100. Prosecutors claim Johnson again falsely claimed Ten Penny employed 16 workers.

In total, Ten Penny received $273,165 in PPP funds, according to federal records.

It is not clear how the funds were used. Johnson did not respond to a phone call and email seeking comment. State records indicate Johnson was removed as Ten Penny’s CEO in August and replaced by Tami Williams.

In 2020, as COVID-19 shutdowns threatened businesses, the U.S. government started issuing nearly $800 billion in potentially forgivable PPP loans. The program was designed to help businesses keep workers employed during the pandemic.

As of August 2020, the SBA had identified more than 70,000 loans totaling over $4.6 billion in potentially fraudulent PPP loans, according to an inspector general report.