PORTLAND, Ore. — Tax Day comes a month later than usual in 2021. The IRS extended the filing and payment deadline to May 17 to allow people more time because of difficulties posed by the pandemic.

Still, many people have waited until the last minute to finish their 2020 taxes, including two of the guests on this week's episode of Straight Talk. Former Portland City Commissioner Steve Novick said he just finished his taxes on Thursday.

"I just signed them today. I procrastinated until today," Novick said.

Economist Dr. Eric Fruits with the Cascade Policy Institute said he's still not done.

"I always file an extension. It's the most painful process and I try to put it off as long as possible," Fruits said.

However, DHM research pollster John Horvick said he files almost as soon as he gets his W-2 form.

"For fans of 'The Simpsons,' I like to think of myself as the Ned Flanders of doing taxes. I'm usually the first guy to get them in," Horvick said.

On Straight Talk, Novick, Fruits, and Horvick discussed where Americans' taxes go, how much is wasted, and what poll numbers say about Oregonians' opinions on taxes.

Where your federal tax money goes

From 2003 to 2005, Steve Novick served as the Communications Director for Citizens for Oregon's Future, a non-profit dedicated to giving citizens information about taxes and government budgets. Novick calls himself "obsessed about the topic," because he said polls show people don't know much about where their tax dollars go. He thinks Americans would feel more united if they knew that most of their tax money goes to popular programs.

The Center on Budget and Policy Priorities reports in 2019, 23% of the federal budget went to Social Security, 25% to Medicare and Medicaid, 16% to defense and international security assistance, and less than 1% to foreign aid.

"The vast majority of taxes go to programs Democrats and Republicans like. More than half goes to Social Security, Medicare and Medicaid, and the military. And the vast majority of Democrats and Republicans are okay with that," Novick said.

Economist Eric Fruits of the Cascade Policy Institute, a non-partisan think tank, said the problem comes, for many taxpayers, when you dig deeper into the federal budget numbers.

"That's when you find things like waste, you might find misplaced priorities. That's where you find crazy experiments like sprinkling badgers with deer urine," Fruits said.

While he admitted that would account for a tiny fraction of the federal budget, he said there are more eye-catching examples of federal dollars that are wasted.

"You have $175 billion spent last year on improper payments in things that they (taxpayers) might agree are popular programs, but the money is going to the wrong person or is the wrong amount for the wrong reason. That's when people say wait a minute, why am I paying for that?" he said.

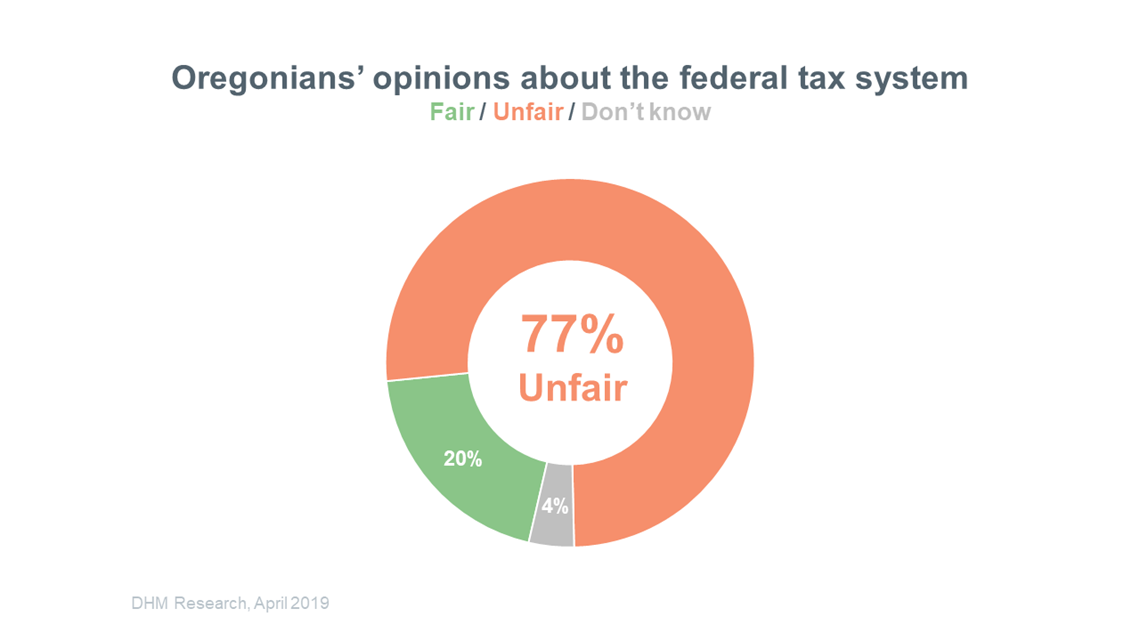

3 in 4 Oregonians think the federal tax system is unfair

Pollster John Horvick said a 2019 DHM poll shows 77% of Oregonians said they think the federal tax system is unfair. Wasteful spending and misallocation of funds are part of the reason, but Horvick said there's another reason for taxpayer skepticism.

"A lot of it has to do with who they think isn't paying their fair share. That's high-income earners and big corporations. They feel like they're paying and a lot of others aren't," Horvick said.

Where your Oregon state taxes go

The 2019-2021 budget shows most of the Oregon state budget going to education, human services which includes health care, and public safety.

Novick said those three areas account for 90% of the state's nearly $86 billion budget.

"Again, I think the vast majority of people think those are important services," Novick said.

Fruits said there's plenty of waste of Oregon taxpayer money, too. He pointed to the $300 million spent on the failed Cover Oregon health insurance exchange website in 2016.

He also believes paying for the state's Medicaid system, the Oregon Health Plan, is unfair for a majority of Oregonians.

"When you look at the population on Medicaid, it's less than one fourth of the population. So you have 75% of the population paying taxes to provide health insurance for the other 25%. And a lot of people, I think, have this belief there is a fundamental unfairness in that," Fruits said.

Novick disagreed and said someday many Oregonians might need that health care coverage, even if they don't now.

"A lot of us are going to wind up eventually in a nursing home or long-term care for seniors, and we are not going to be able to pay for it ourselves," said Novick. "Even if we are not part of that group now, when we are older, we are likely to be a part of it."

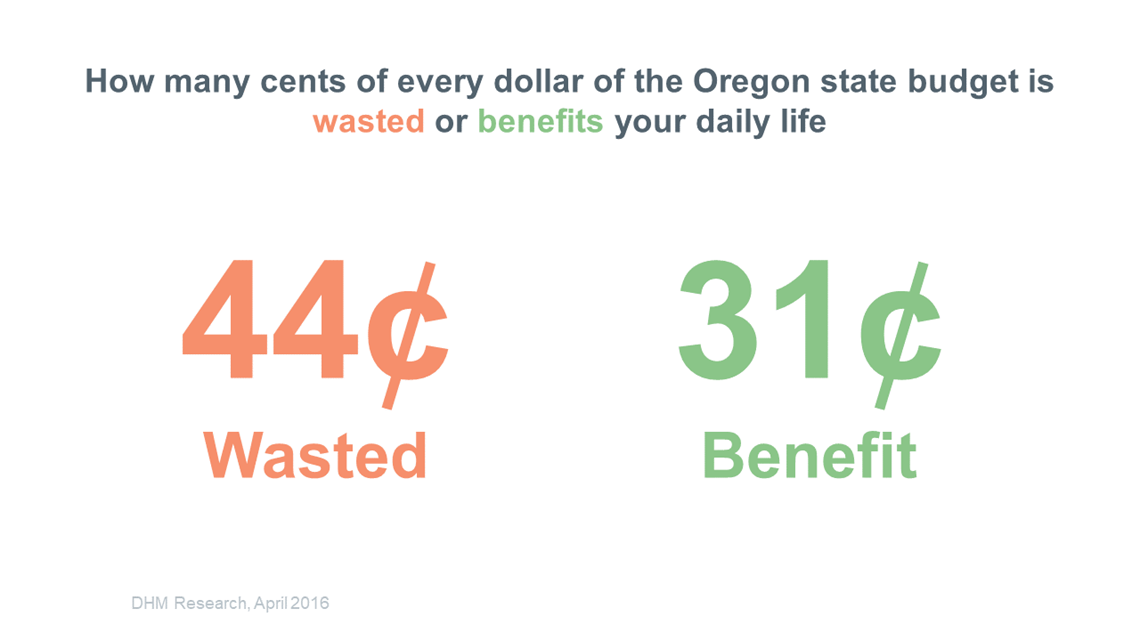

According to Horvick, a 2016 poll showed Oregonians think about 44 cents of every Oregon tax dollar is wasted compared to 31 cents spent on things that benefit their lives. But, he said, Oregonians have twice voted to increase taxes to fund the expansion of Medicaid.

"There is a general sense that there is money wasted and there's skepticism. But on the specifics, Oregonians have said many times, it's okay to raise taxes for specific services they want to see," Horvick said.

Novick, Fruits, and Horvick also discussed the many local taxes Oregonians voted for in May and November of 2020 during the pandemic, including the new Multnomah County income tax on high-income earners to pay for universal preschool.

Straight Talk airs Friday at 7 p.m., Sunday at 6:30 p.m., and Monday at 4:30 a.m.